[ad_1]

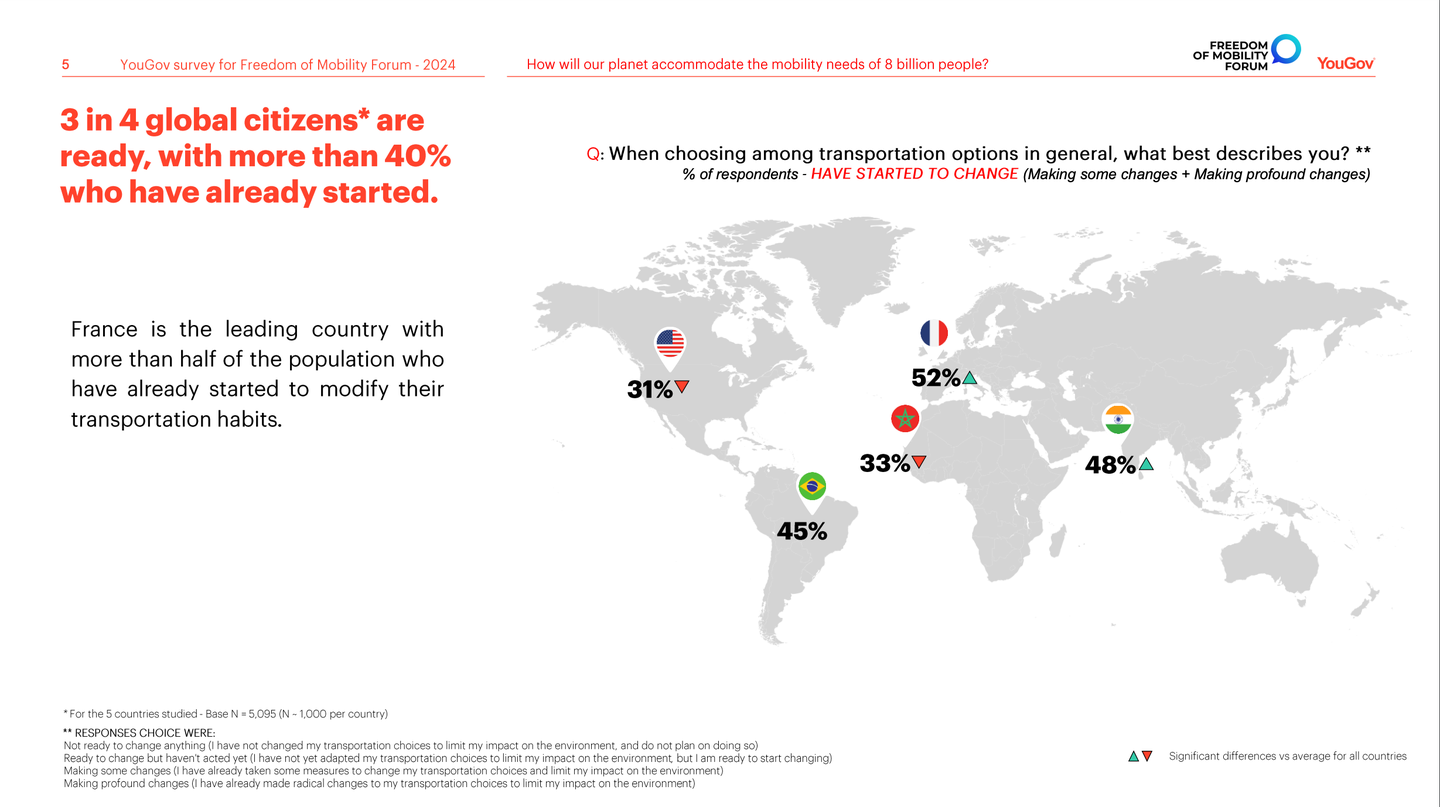

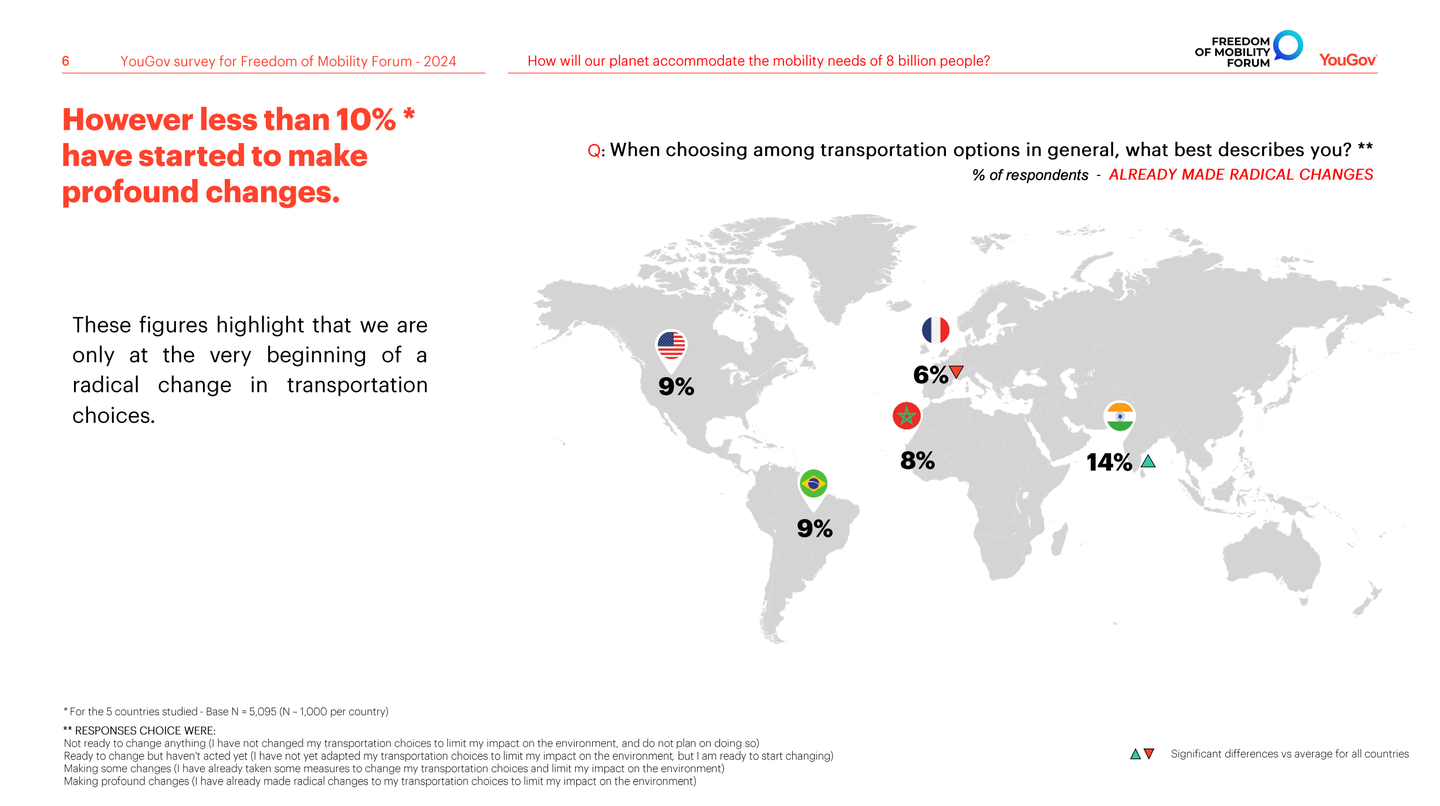

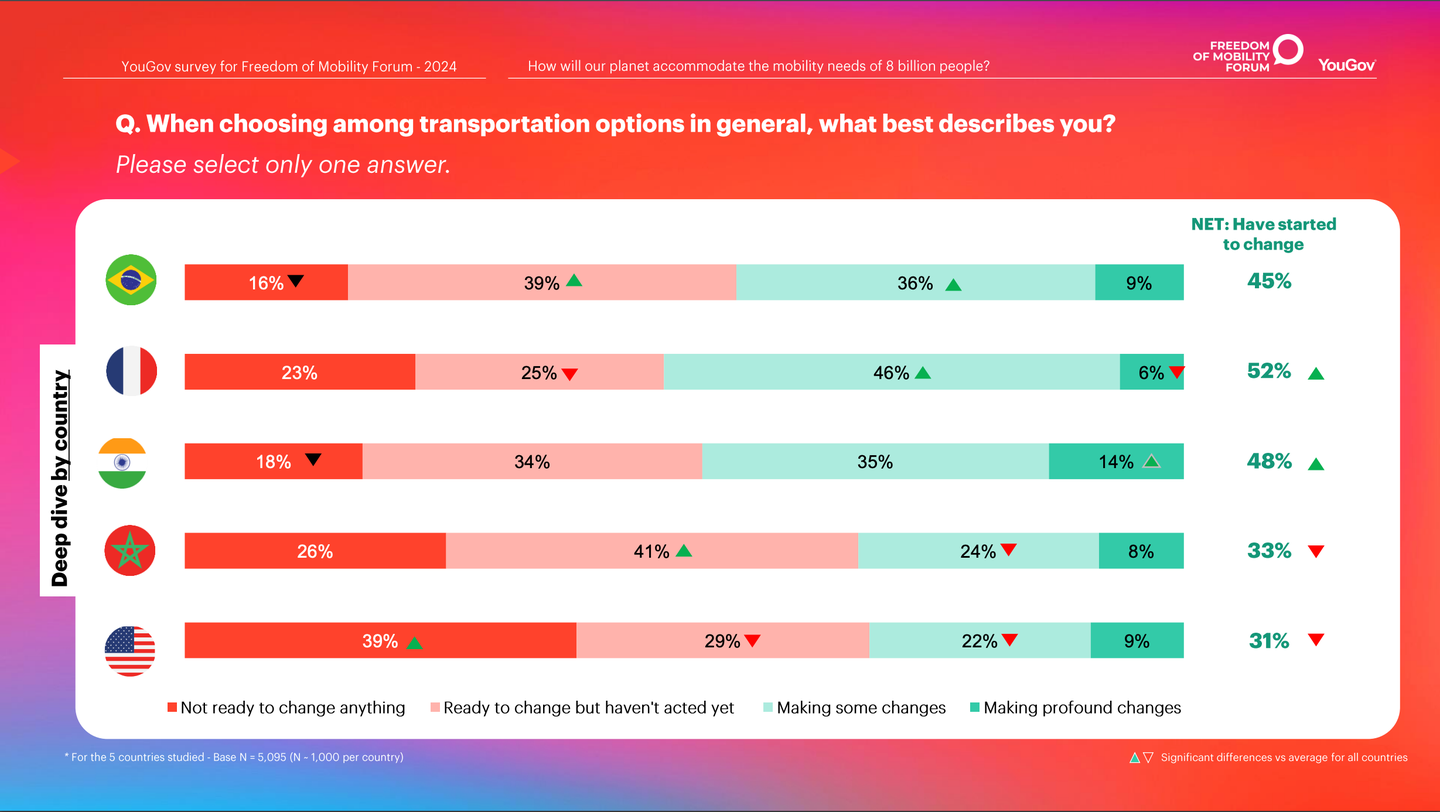

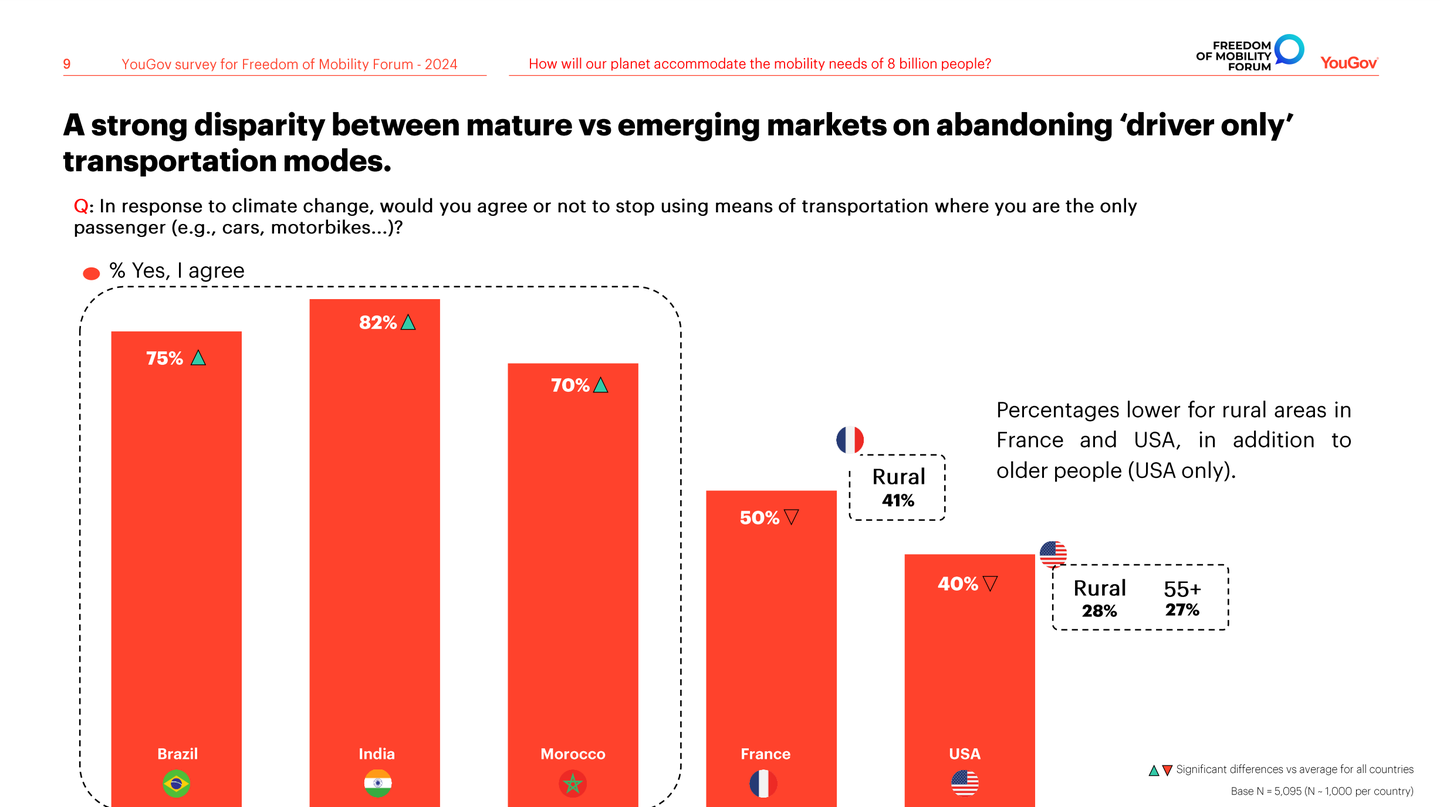

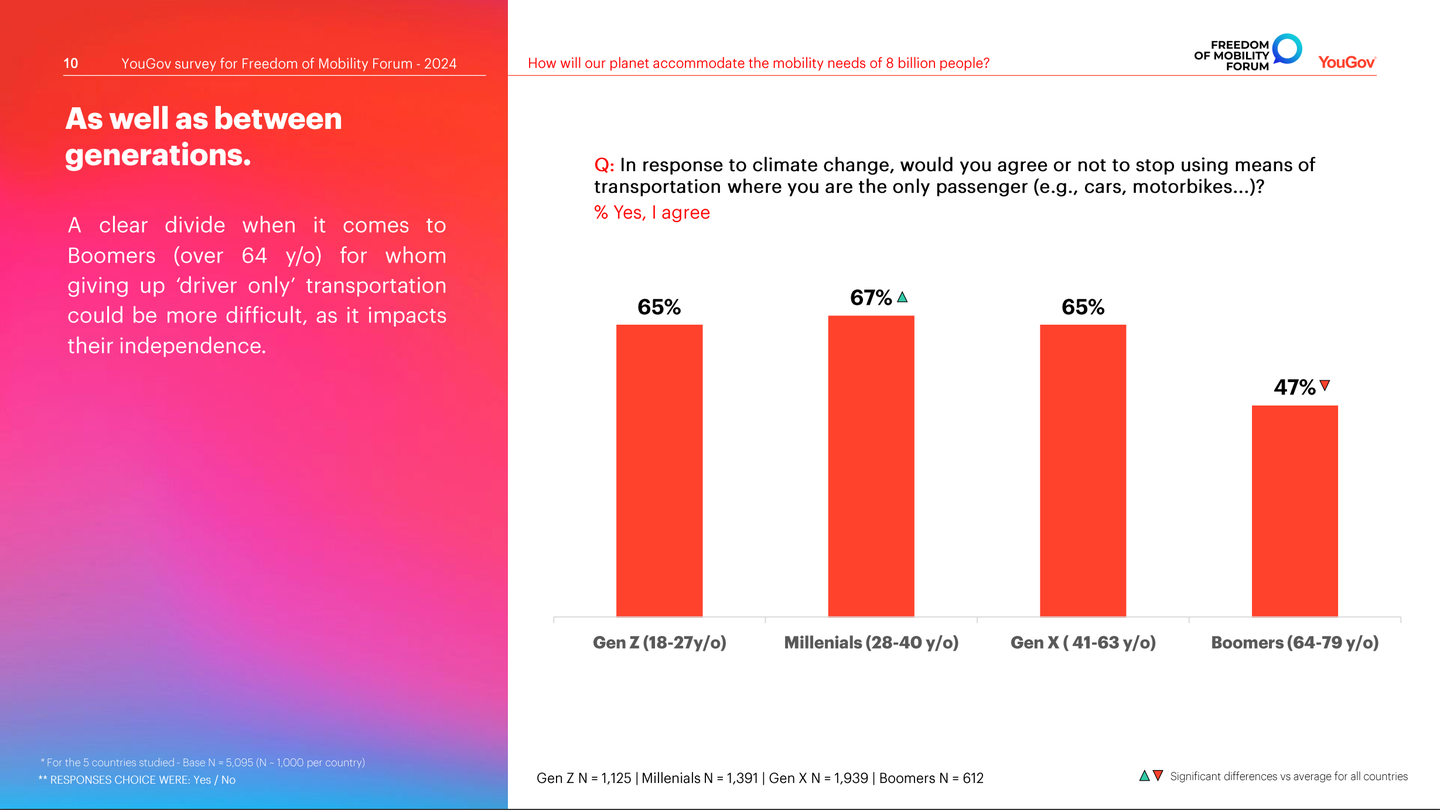

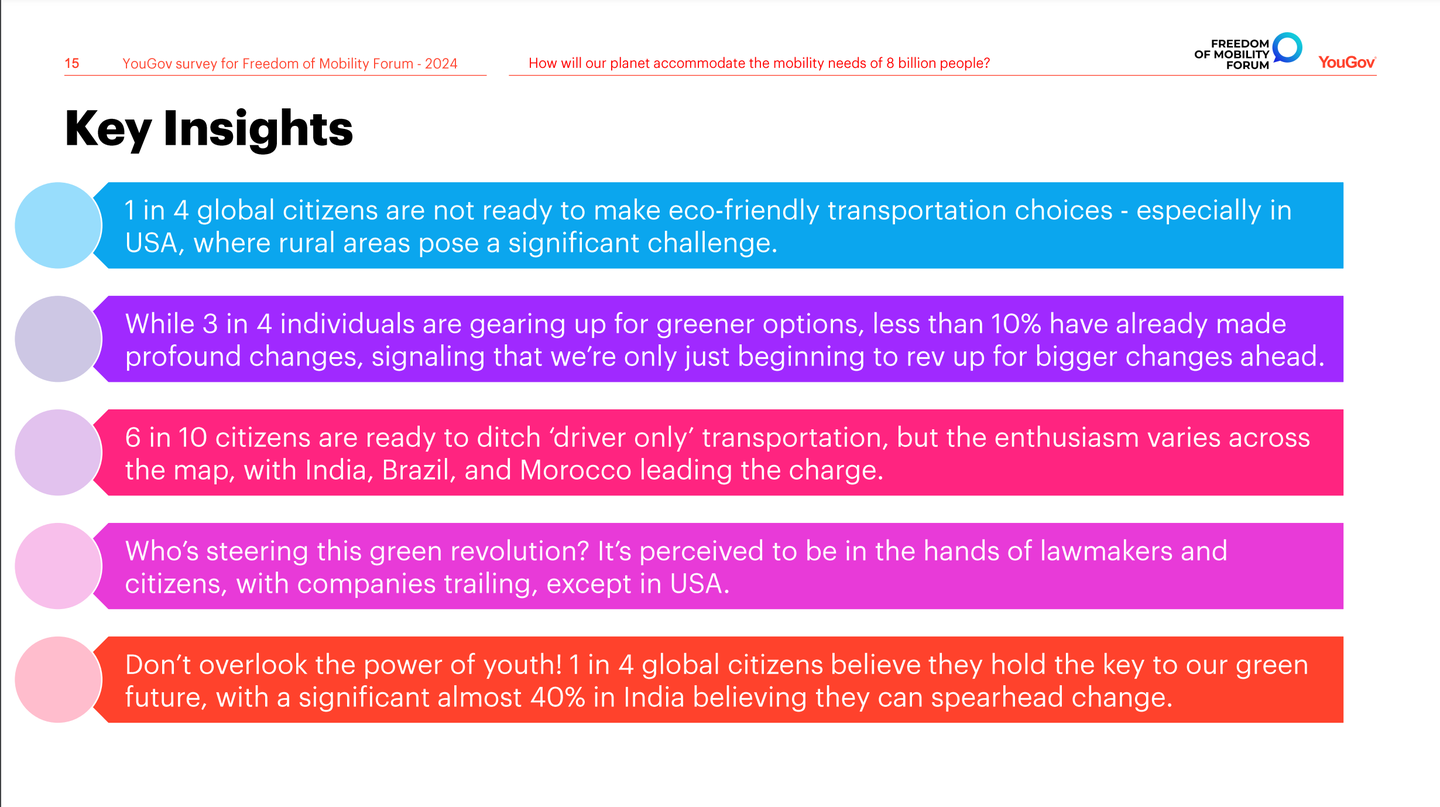

Some findings were foreseeable. Three out of four respondents globally identified themselves as “prepared to alter” their travel routines, but only a small portion had actually taken substantial steps to do so—less than 10%. Generally, older consumers and those in rural regions were more hesitant towards eco-friendly transportation like EVs, whereas young individuals in urban areas leaned more towards that direction. The younger, urban populations were also more open to relinquishing “solo-driver” modes of transport such as cars and motorcycles in favor of public transit. So far, so clear.

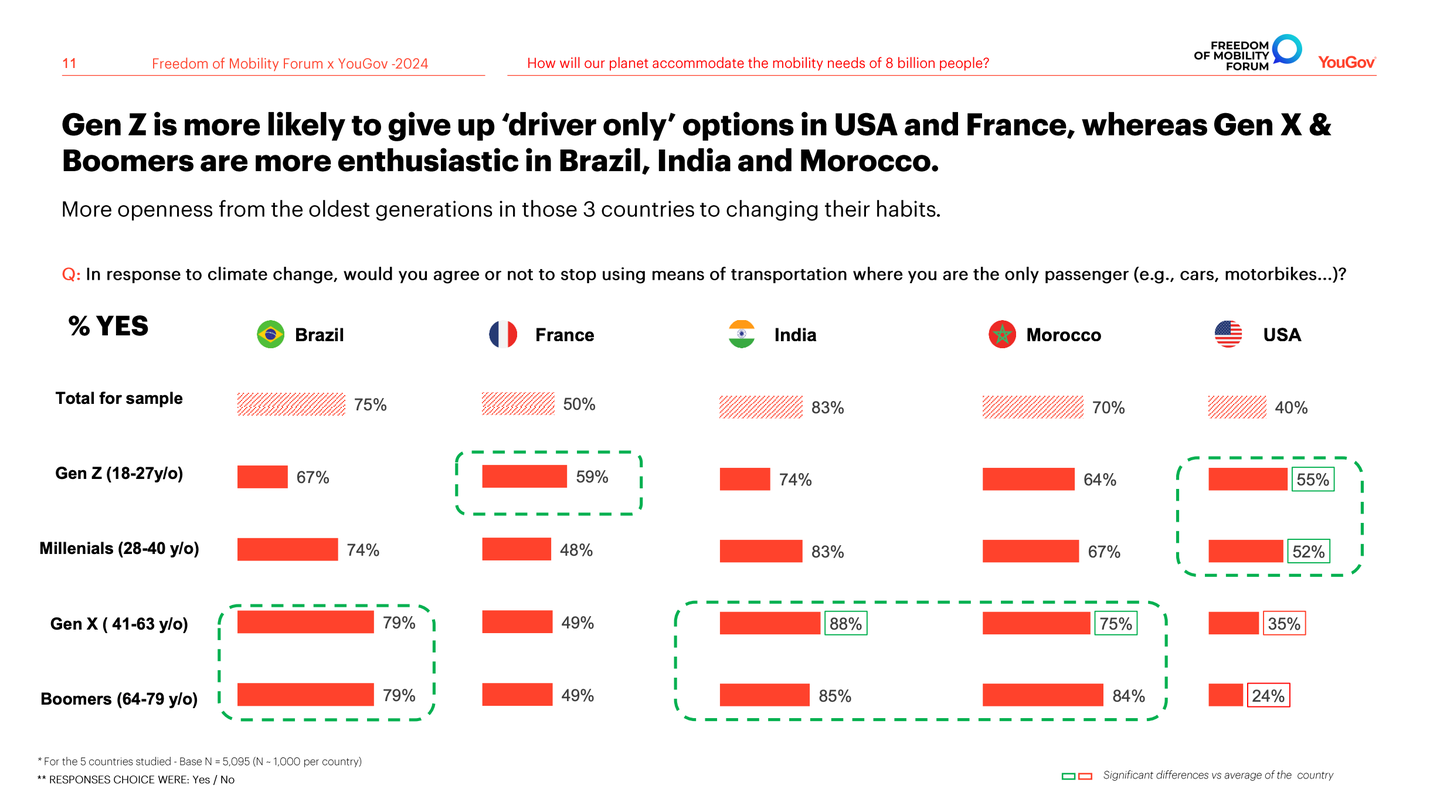

These outcomes were based on broad averages, though. Upon delving deeper, the data becomes intricate. The U.S., for instance, significantly lowered the overall percentage of older individuals willing to switch to public transit: Only 24% of American Baby Boomers were on board. In contrast, older participants in every other country were as supportive of public transit as the younger demographic. In countries like Brazil, India, and Morocco, the older population spearheaded the movement, with 70-80% of seniors willing to trade their vehicles for public transit.

The issue of which entities possessed the most influence in promoting eco-friendly transportation also displayed distinct national disparities. While everyone ranked the government among the top three, other perceptions varied. Countries like France and the U.S. highlighted corporations as significant players. On the other hand, Brazil and Morocco leaned towards the media. India placed young people at the forefront.

In essence, if there exists a straightforward, data-backed response to the query of “are EVs the future?” this survey does not offer it. Rather, it presents a concise, well-organized overview of the complexities that a global brand such as Stellantis must navigate to achieve profitability.

Got pointers? Send them to tips@thedrive.com

[ad_2]