[ad_1]

<

div class=”entry-content”>

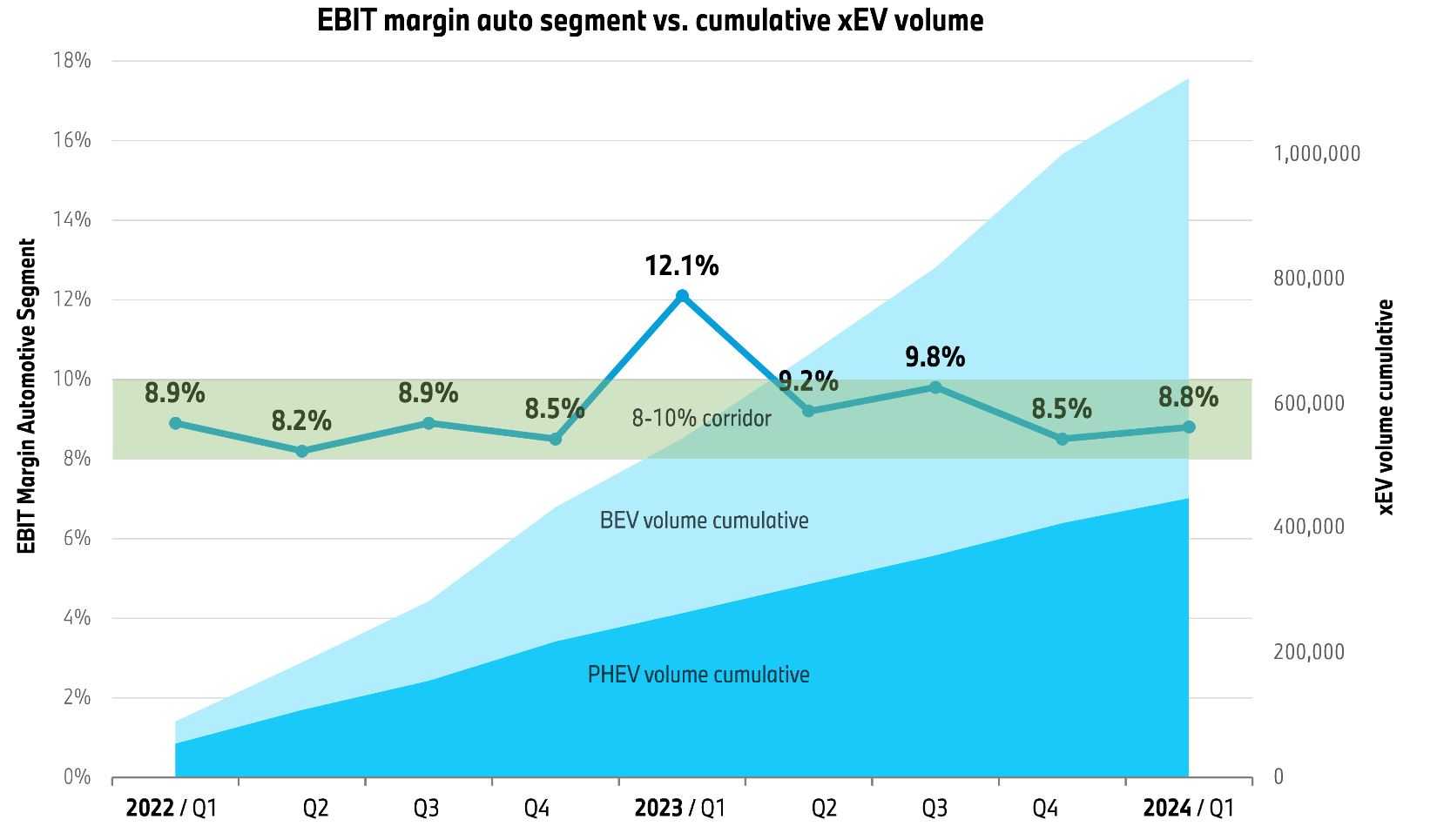

BMW Group sustains its thriving trajectory in 2024: alongside its active BEV expansion, the corporation accomplished its margin objectives. Throughout the initial three months of the year, the corporation distributed approximately 83,000 all-electric vehicles across its BMW, MINI and Rolls-Royce brands and boosted BEV sales by about 28 percent. The BMW brand raised its overall sales by 2.5%. Simultaneously, the EBIT margin in the Automotive segment of 8.8 percent stayed within the 8-10 percent target range, according to the full-year guidance. The EBT margin at Group level exceeded the strategic target of over 10 percent, standing at 11.4 percent.

After overcoming the hurdles of the corona pandemic and chip supply, the corporation has continuously met its 8-10% strategic EBIT corridor quarter after quarter since Q1 2022. This progress has occurred in conjunction with its swift expansion of electric mobility: Over the past two years, the BMW Group has supplied over 1.1 million electrified vehicles to customers, with more than 60% of these being solely electric BEV models. The BEV share is consistently climbing, as planned.

During the first three months of 2023, the EBIT margin of the Automotive segment reached 12.1%. The EBIT in the first quarter of the previous year benefited from the lower purchase price level of 2022, with stocks having lower manufacturing costs being unloaded. The rise in production costs due to inflation affected the profit & loss statement of BMW AG following the second quarter of 2023. This higher cost level persisted into Q1/2024.

“The past nine quarters underscore BMW’s consistency and dependability: We are expanding the electric vehicle share dynamically as planned while upholding our substantial profitability. Some see this as transformation — for us, it is an ongoing evolution,” noted the Chairman of the Board of Management of BMW AG, Oliver Zipse, on Wednesday. “We will sustain this trajectory: We are presenting our clientele with cutting-edge innovations and technology — across all vehicle drivetrains. Consequently, we continue to provoke strong demand with exceptional products.”

Automotive markets on the rise – BMW Group deliveries climb

With a total of 594,533 automobiles distributed to customers in the first three months, the firm recorded a minor increase of 1.1% versus the preceding year, confirming its dominant position in the worldwide premium sector.

Throughout the quarter, the primary automotive markets largely exhibited an ascending pattern due to pent-up demand and heightened sales in the mid-range price segment. The BMW Group profited from its youthful and incredibly appealing product lineup: The BMW brand retailed 530,933 units in the initial quarter, marking a 2.5% rise year-on-year. It experienced a sales surge of 2.4% (84,475 units) in the USA and a considerable growth of 10.2% in Europe with 188,863 units delivered. In China, the volume segment saw dynamic growth in lower price brackets, while the premium segment saw a slight decline. The BMW brand traded 182,998 vehicles, aligning with segment growth (2023: 190,774 units/-4.1%). In Germany, deliveries surged by 4.6% to 49,509 premium vehicles.

Key growth drivers among the 78,682 BMW BEVs delivered were the popular BMW i4*, alongside the BMW iX1* and BMW i7*. The BMW brand’s fully electric vehicles saw notably robust growth of +40.6%. A total of 122,582 BMW Group electrified vehicles, BEVs, and PHEVs were provided to customers, constituting a sales share of nearly 21%.

Further sales momentum is anticipated later in the year from the BMW iX2* and BMW i5*, currently undergoing escalation.

Fully electric models grew to 13.9% of total sales (2023: 11.0%). Once more, upper price segment models emerged as substantial growth catalysts — with deliveries climbing by 21.6%.

The MINI brand is undergoing an extensive model overhaul. Recently introduced, for the first time, was the new MINI Countryman* with an all-electric propulsion system alongside the traditional internal combustion engine. This will be followed by the new MINI Cooper*, set to debut in mid Q2 with a combustion engine or as an entirely electric vehicle. The all-electric MINI Aceman* had its global premiere at the Beijing Motor Show, serving as the brand’s first premium small car segment cross-over model. These new models are poised to deliver further momentum from the second half of 2024. MINI distributed 62,075 vehicles to customers in Q1 (2023: 68,541 units/-9.4%).

The Rolls-Royce brand made a striking e-mobility entrance with the Rolls-Royce Spectre*: Solely in the first quarter of 2024, the Rolls-Royce luxury marque delivered 579 fully electric super coupés to their new owners; 38% of the total 1,525 vehicles were electrified (2023: 1,640 automotive/-7.0%).

Currency-adjusted Group revenues slightly upsurge

Revenue in the first quarter for the Group amounted to € 36,614 million, reaching the previous year’s record high figures (2023: € 36,853 million/-0.6%). The upturn in group revenue was buoyed by higher sales volumes and a more advantageous product mix.

Group EBT margin surpasses >10% target

Between January and March, the BMW Group recorded pre-tax earnings (EBT) of € 4,162 million (2023: € 5,129 million/-18.9%). The EBT includes a financial result of € 108 million (2023: € -246 million), reflecting the market shifts in interest rates and currency hedging transactions. The EBT margin for this period stood at 11.4% (2023: 13.9%), exceeding the full year target of over 10%. Group net profit for the initial quarter totaled € 2,951 million (2023: € 3,662 million/-19.4%).

BMW AG’s share buyback initiative continues

Authorized by the Annual General Meeting of BMW AG on 11 May 2022, the corporation commenced share repurchases. Shares repurchased in the first program have already been annulled. As of 31 March 2024, BMW AG possesses 8,004,314 treasury shares, valued at € 8,004,314. Under this mandate, BMW AG procured shares equivalent to 5.03% of the share capital as of March 31, 2024.

8.8% Automotive Segment EBIT margin aligns with annual target range

The Automotive Segment generated revenues of € 30,939 million in the initial quarter (2023: € 31,268 million/-1.1%). Excluding currency translation hurdles, especially from the Chinese renminbi and the US dollar, revenue displayed a year-on-year escalation of +1.5%. Higher sales volumes and a more favorable product mix…blend results from the higher-priced bracket and electric vehicles boosted revenues within specific segments, highlighting the sturdy operational performance of the primary business. Product prices are projected to remain consistent with the previous year in 2024.

The initial quarter accounted for € 2,710 million in earnings before financial results (EBIT) (2023: € 3,777 million/-28.2%). The auto segment’s EBIT margin stood at 8.8% (2023: 12.1%), aligning with the annual target of 8-10%. EBIT was affected by escalated manufacturing expenses. The comparably lower procurement costs of 2022 were no longer a benefit from the second quarter of 2023 onwards, extending over to the first quarter of 2024.

Noteworthy shifts in commodity prices had a favorable impact of several hundred million euros on EBIT, while currency fluctuations maintained neutrality. The BMW Group foresees a positive net outcome from currency and commodity positions for the full year 2024.

Results from the resale of leased vehicles created challenges in contrast to Q1/2023 but remained positive overall. The competitive landscape heated up starting from the second quarter of 2023 due to better vehicle availability, causing a gradual softening in the global pricing environment for both new and pre-owned cars, which extended into Q1 2024.

Anticipating a slightly advantageous year-over-year impact from volume, product composition, and pricing, the company also prepares for the additional boost expected from the introduction of the new 5 series and improved availability of the 7 series models in their first full year, thereby enhancing the overall product mix.

In addition to higher manufacturing costs, the auto segment’s EBIT was influenced by escalated selling & administrative expenses, primarily attributed to IT projects and a personnel cost uptick enforced from Q3 2023.

Staying faithful to its strategic plans, BMW Group is embarking on its most significant investments this year. An emphasis on record-breaking levels of R&D expenses and capital investment is emblematic of the company’s unwavering commitment to innovation, efficient eco-friendly technologies, further electrification, digital transformation, and product range expansion.

Emphasizing its current robust operational performance, the BMW Group registered R&D expenses of € 1,974 million (2023: € 1,554 million/+ 27.0%) in the first quarter. Investments leaned heavily towards advancing electrification, digitalization, automated driving systems, NEUE KLASSE models, and upcoming successors like the BMW X5.

The R&D ratio (as per the German Commercial Code) surged to 5.4% (2023: 4.2%), with projections indicating a ratio surpassing 5.0% for the full year.

The initial quarter witnessed a strain on the free cash flow of the automotive segment due to heightened working capital necessitated by increased inventory levels ensuring adequate market supplies within customer-friendly lead times.

Capital expenditure totaling € 1,323 million (excluding capitalized development costs) was channeled into various facilities focusing on vehicle projects, particularly accentuating electrification and digitalization (2023: € 1,328 million/-0.37%). The capex ratio</strong was recorded at 3.6% (2023: 3.6%), with a projection exceeding 6% for the full year.

In Q1 2024, investments totaling € 2.3 billion were allocated towards future models and innovations. Despite this, the Automotive Segment generated a free cash flow of € 1,283 million (2023: € 1,981 million/-35.2%).

For the entire year, the BMW Group is aiming for a free cash flow within the Automotive Segment surpassing € 6 billion, despite 2024’s peak investments in R&D and CAPEX.

Walter Mertl, responsible for Finance as a member of the Board of Management, remarked, “A strategic and flexible approach to business embedded with a revenue-focused direction defines the BMW Group’s resilient operational performance. This strength positions us favorably on our extensive journey towards a diversified portfolio of electrified and digital products. Adapting to the digital and electric future consumes the greatest portion of our investment this year.”

Financial services witness robust growth in fresh business

During the first quarter of 2024, BMW Group Financial Services observed dynamic development in its financing and leasing operations. Fresh retail contracts with end-users experienced a significant rise, with the number of contracts increasing by 21.5% to a total of 422,056 contracts (2023: 347,298 contracts).

The total value of new business from retail financing and leasing contracts amounted to € 15,620 million (2023: € 12,788 million/+22.1%). The proportion of BMW Group new vehicles leased or financed by the Financial Services Segment reached 41.8% by the end of the first quarter (2023: 36.5%/+5.3 percentage points).

In the three-month period, pre-tax earnings stood at € 730 million (2023: € 945 million/-22.8%) for the segment. Earnings were impacted by increased risk provisioning and diminished income from end-of-lease vehicle resale compared to the prior year. Expectedly, prices in the pre-owned vehicle markets continued their decline. Despite this, the credit loss ratio remained stable at a low 0.21% across the loan portfolio (2023: 0.13%).

BMW Group Financial Services has taken appropriate measures to manage risks effectively.

BMW motorcycles kick off the season with vigor

During the first quarter, BMW Motorrad successfully delivered 46,434 motorcycles and scooters to customers. The brand anticipates sustained demand for its new product lineup throughout the year. Notably, the recently introduced models like the F 800 GS, the F 900 GS, and the R 1300 GS are witnessing significant popularity since their launch, further reinforcing the growth strategy of the segment. The EBIT margin stood at 12.2% (2023: 16.5%), outperforming the full-year target range of 8-10%.

BMW Group reaffirms its projections

Forecasts suggest a 3.2% global economic growth increment for 2024. If the current economic revitalization in many regions persists, growth prospects could be even more optimistic. However, potential escalations in ongoing disputes, along with increased geopolitical tensions, pose adverse effects.

The BMW Group anticipates leveraging its strong geographic positioning to partake in this growth. With a consistent demand for its premium vehicle offerings, the company reaffirms its projections for the year, anticipating customer growth.Shipments globally by 2024.

The forecast for Group pre-tax earnings suggests a slight decrease, mainly due to increased production and fixed expenses, particularly labor costs and research and development spending, compared to the previous year. The expected decline in secondhand car prices is also likely to contribute to this trend.

The BMW Group anticipates an EBIT margin within the range of 8-10% for the entire year in the Automotive Segment.

In the Motorcycles Segment, a minor boost in shipments is predicted alongside an EBIT margin in the targeted range of 8-10%.

The anticipated Return on Equity (RoE) in the Financial Services Segment falls between 14 and 17%.

These objectives will be accomplished with a slight increase in staff numbers.

| A Comprehensive Overview of the BMW Group in Q1 2024 | Q1 2024 | Q1 2023 | Change in % | |

| Customer Deliveries | ||||

| Automotive1 | units | 594,533 | 588,138 | 1.1 |

| including: BMW | units | 531,039 | 517,957 | 2.5 |

| MINI | units | 62,107 | 68,541 | -9.4 |

| Rolls-Royce | units | 1,525 | 1,640 | -7.0 |

| Motorcycles | units | 46434 | 47,935 | -3.1 |

| Employees (as of Dec 31, 2023) | 154,950 | |||

| Automotive Segment EBIT margin | percent | 8.8% | 12.1% | -27.5 |

| Motorcycles Segment EBIT margin | percent | 12.2% | 16.5% | -26.4 |

| BMW Group EBT margin2 | percent | 11.4% | 13.9% | -18.0 |

| Revenues | € million | 36,614 | 36,853 | -0.6 |

| including: Automotive | € million | 30,939 | 31,268 | -1.1 |

| Motorcycles | € million | 872 | 933 | -6.5 |

| Financial Services | € million | 9,525 | 8,826 | 7.9 |

| Other Entities | € million | 4 | 3 | 33.3 |

| Eliminations | € million | -4,726 | -4,177 | 13.1 |

| Profit before Financial Result (EBIT) | € million | 4,054 | 5,375 | -24.6 |

| including: Automotive | € million | 2,710 | 3,777 | -28.2 |

| Motorcycles | € million | 106 | 154 | -31.2 |

| Financial Services | € million | 714 | 958 | -25.5 |

| Other Entities | € million | -5 | -4 | 25.0 |

| Eliminations | € million | 529 | 490 | 8.0 |

| Profit before Tax (EBT) | € million | 4,162 | 5,129 | -18.9 |

| including: Automotive | € million | 2,703 | 3,828 | -29.4 |

| Motorcycles | € million | 106 | 154 | -31.2 |

| Financial Services | € million | 730 | 945 | -22.8 |

| Other Entities | € million | 401 | -128 | -413.3 |

| Eliminations | € million | 222 | 330 | -32.7 |

| Group Income Taxes | € million | -1,211 | -1,467 | -17.5 |

| Net Earnings | € million | 2,951 | 3,662 | -19.4 |

| Common Stock Earnings per Share | € | 4.42 | 5.31 | -16.8 |

| Preferred Stock Earnings per Share3 | € | 4.42 | 5.31 | -16.8 |

SOURCE: BMW Group