[ad_1]

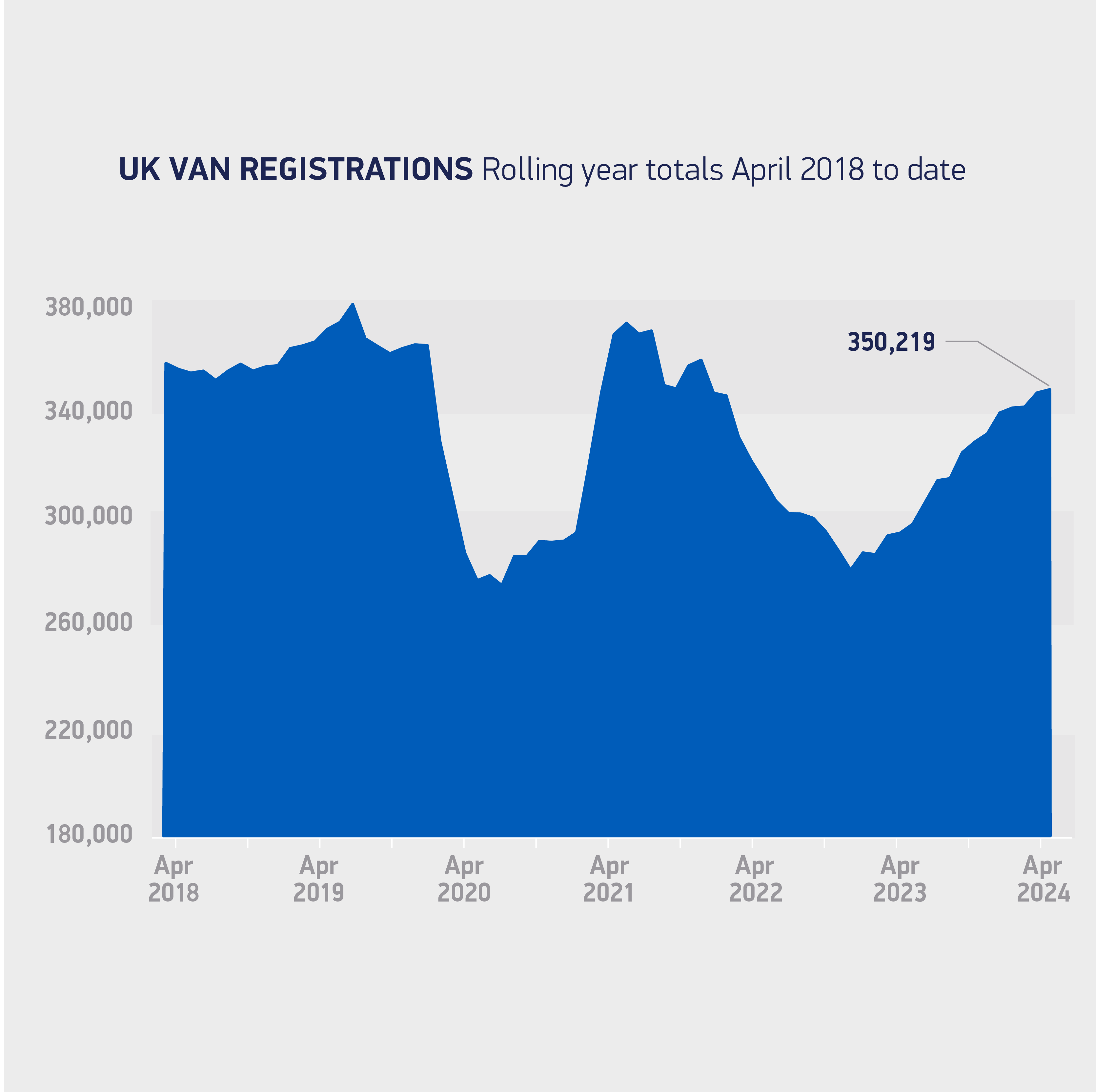

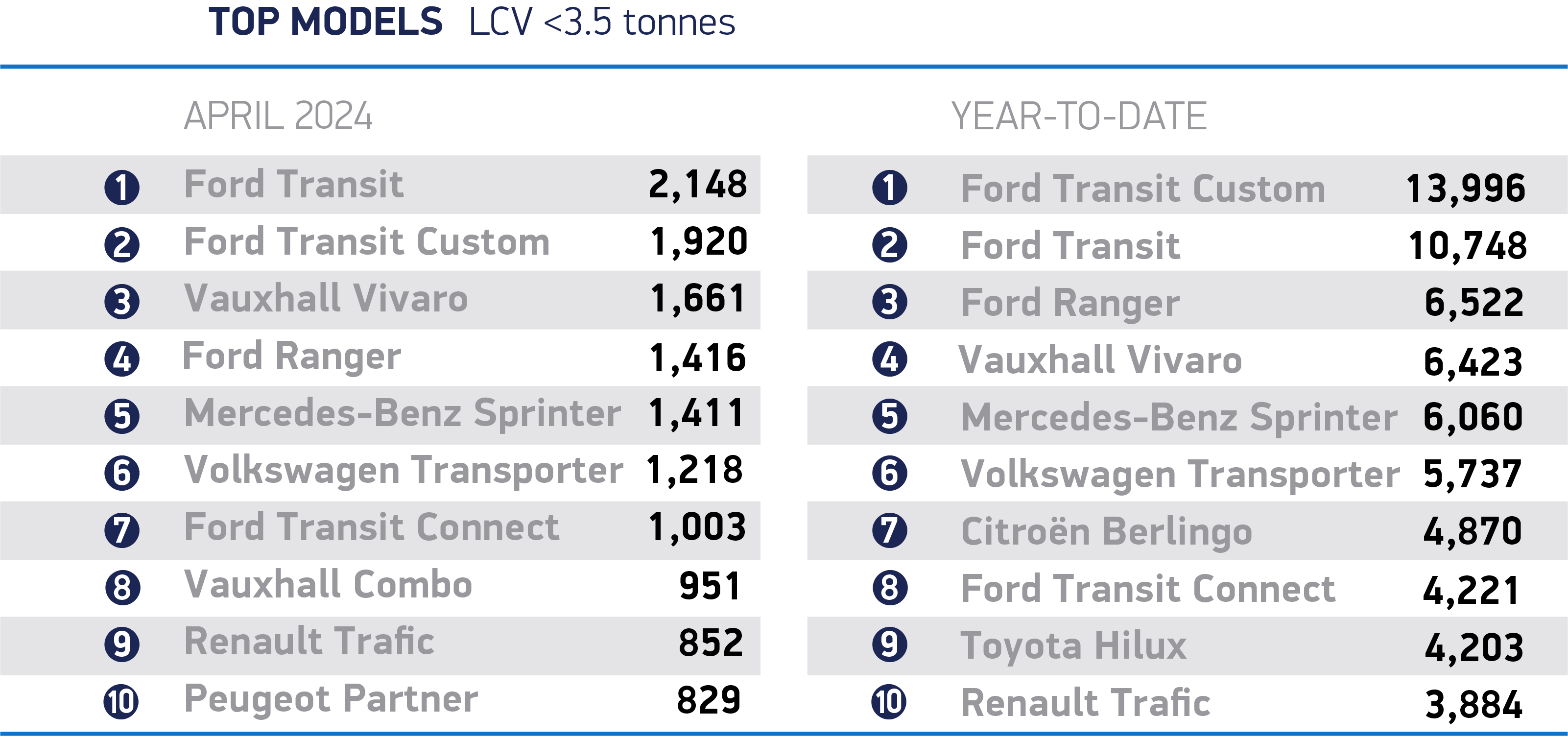

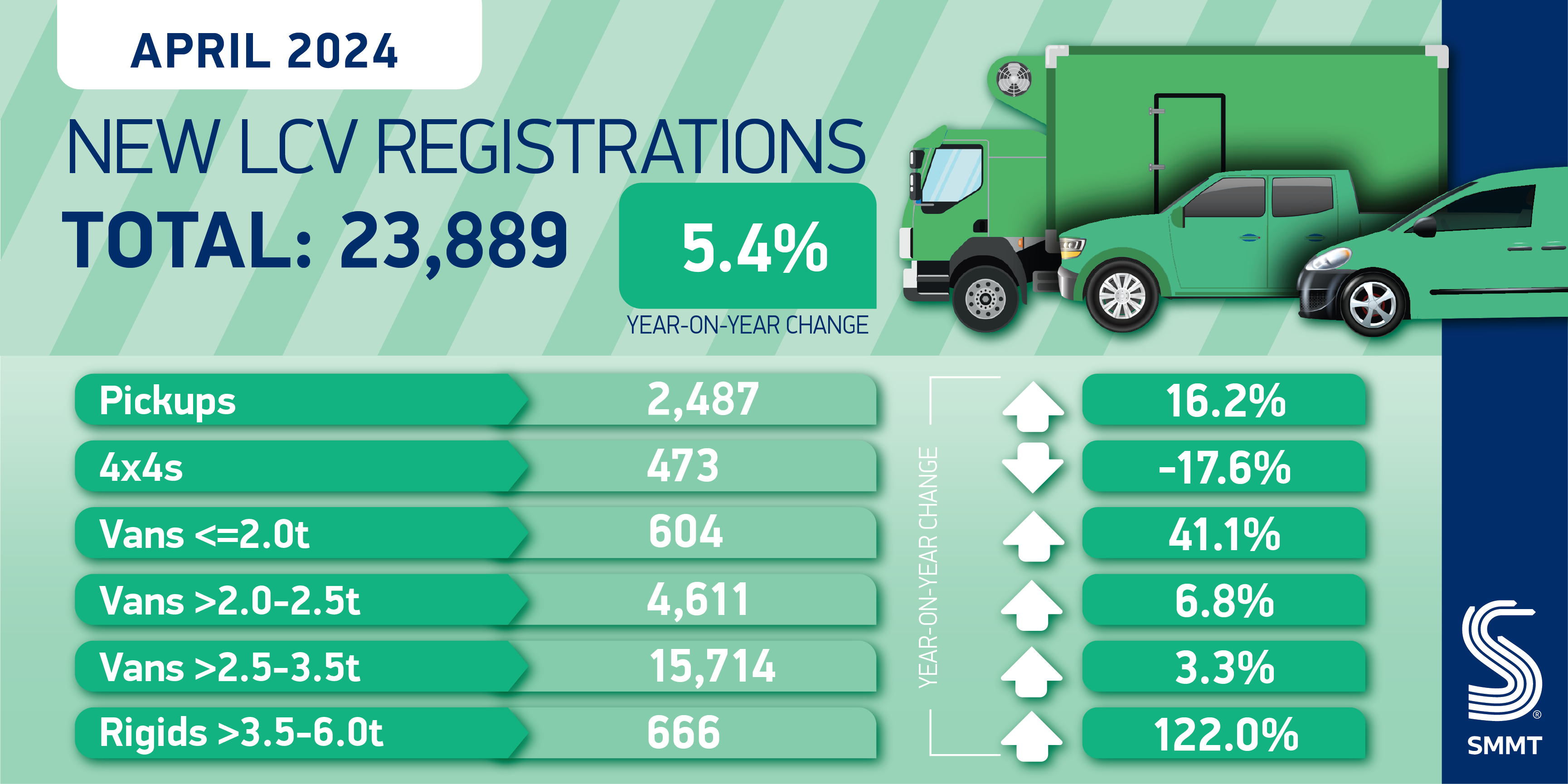

British appetite for new lightweight commercial vehicles (LCVs) surged by 5.4% in April as more enterprises embraced the latest editions, as per recent data released today by the Society of Motor Manufacturers and Traders (SMMT). A total of 23,889 new vans, 4x4s, and pickups were registered, marking the highest number since 2021, with fleets investing in vehicles to support local trades, doorstep services, and other crucial aspects of the logistics sector.1

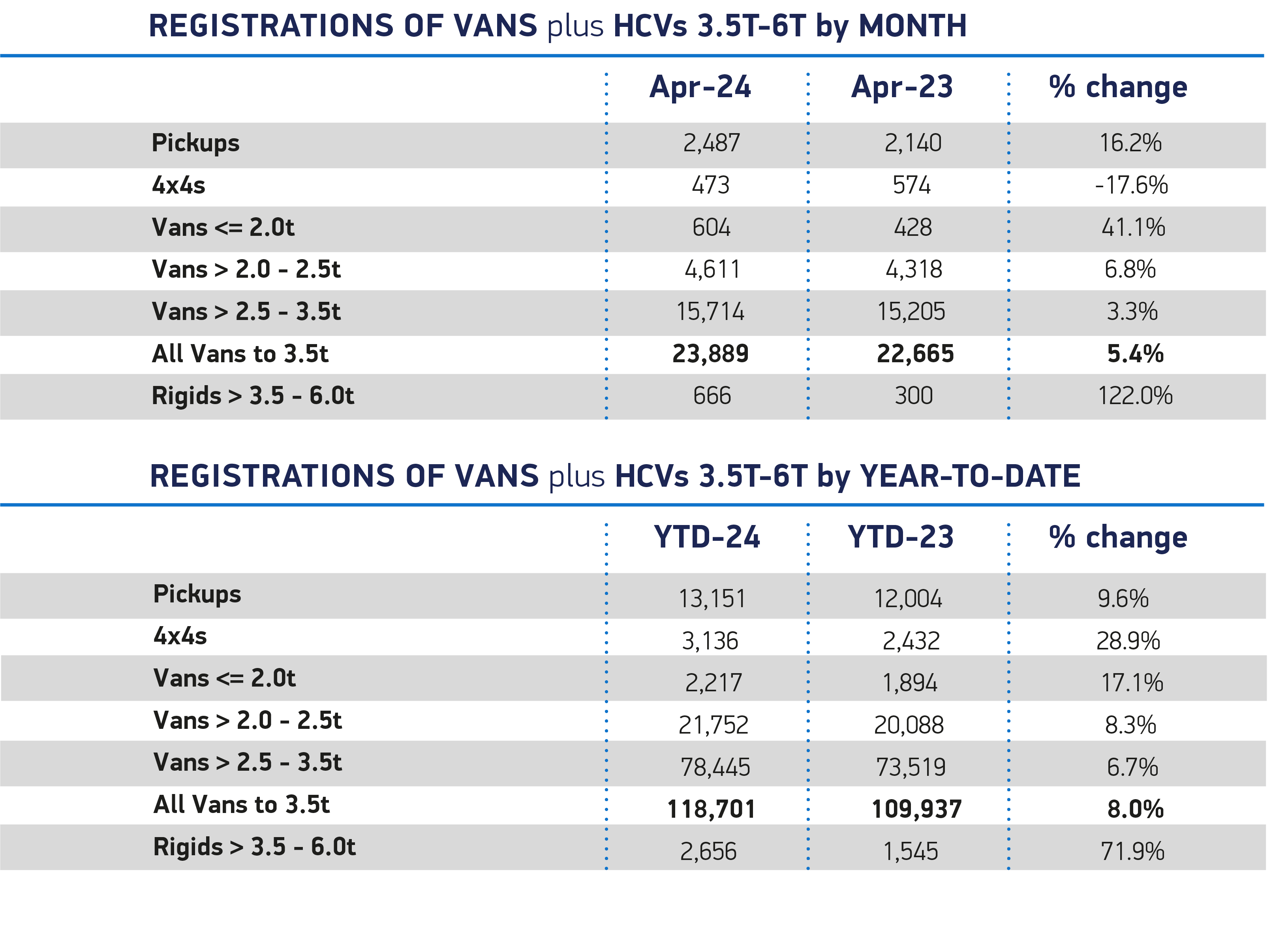

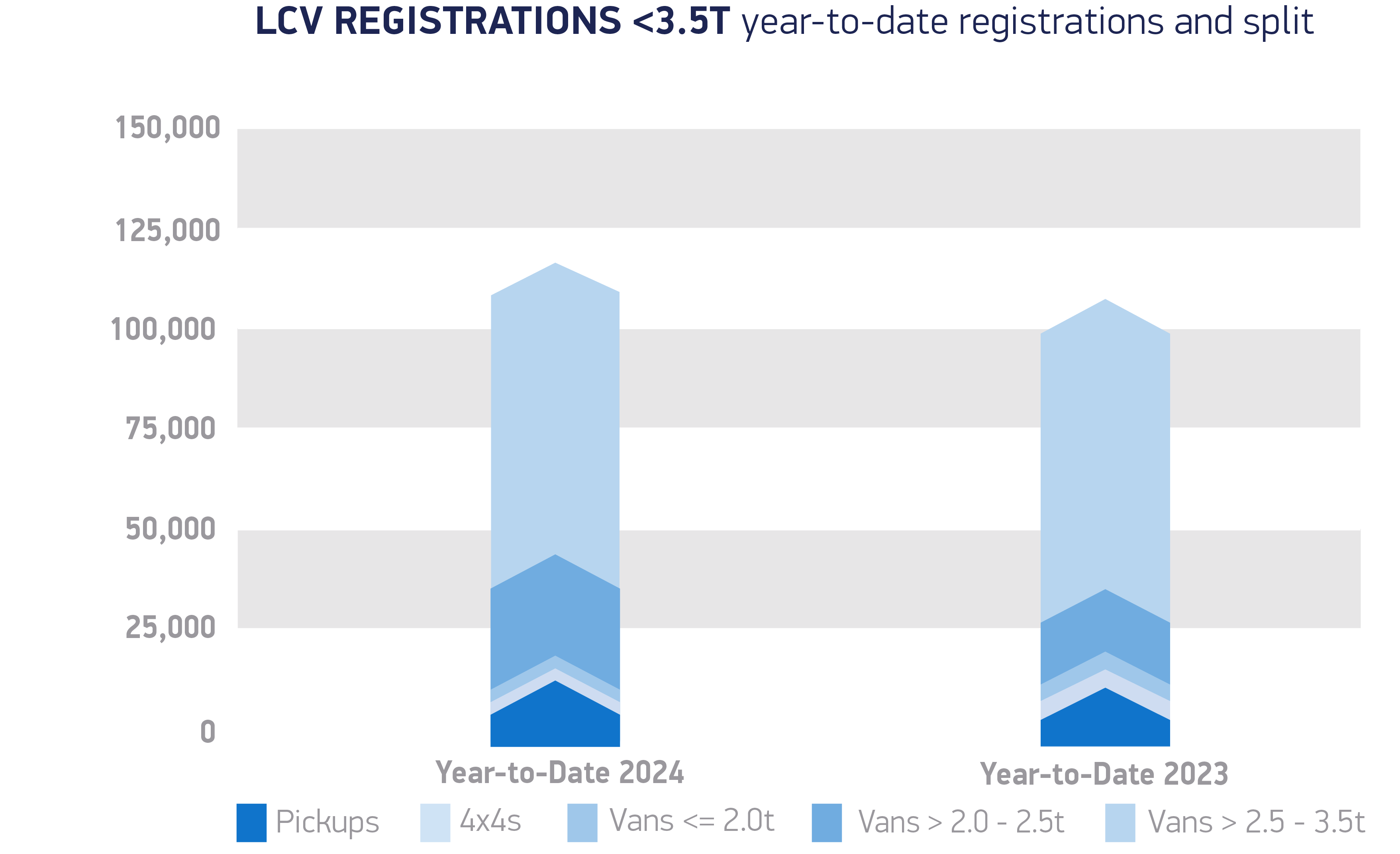

The expansion across the market was sustained by the enduring appeal of the largest LCV models, weighing between 2.5 tonnes and 3.5 tonnes, increasing by 3.3% to 15,714 units – constituting nearly two-thirds (65.8%) of registrations. Medium-sized vans witnessed a growth of 6.8%, reaching 4,611 units, while the steepest percentage rise was for the smallest vans, soaring by 41.1% – yet they only represented 2.5% of the market. Pick-up truck volumes also climbed by 16.2% to 2,487 units, although new 4×4 deliveries dropped by -17.6% to 473 units, compared to a robust April last year.

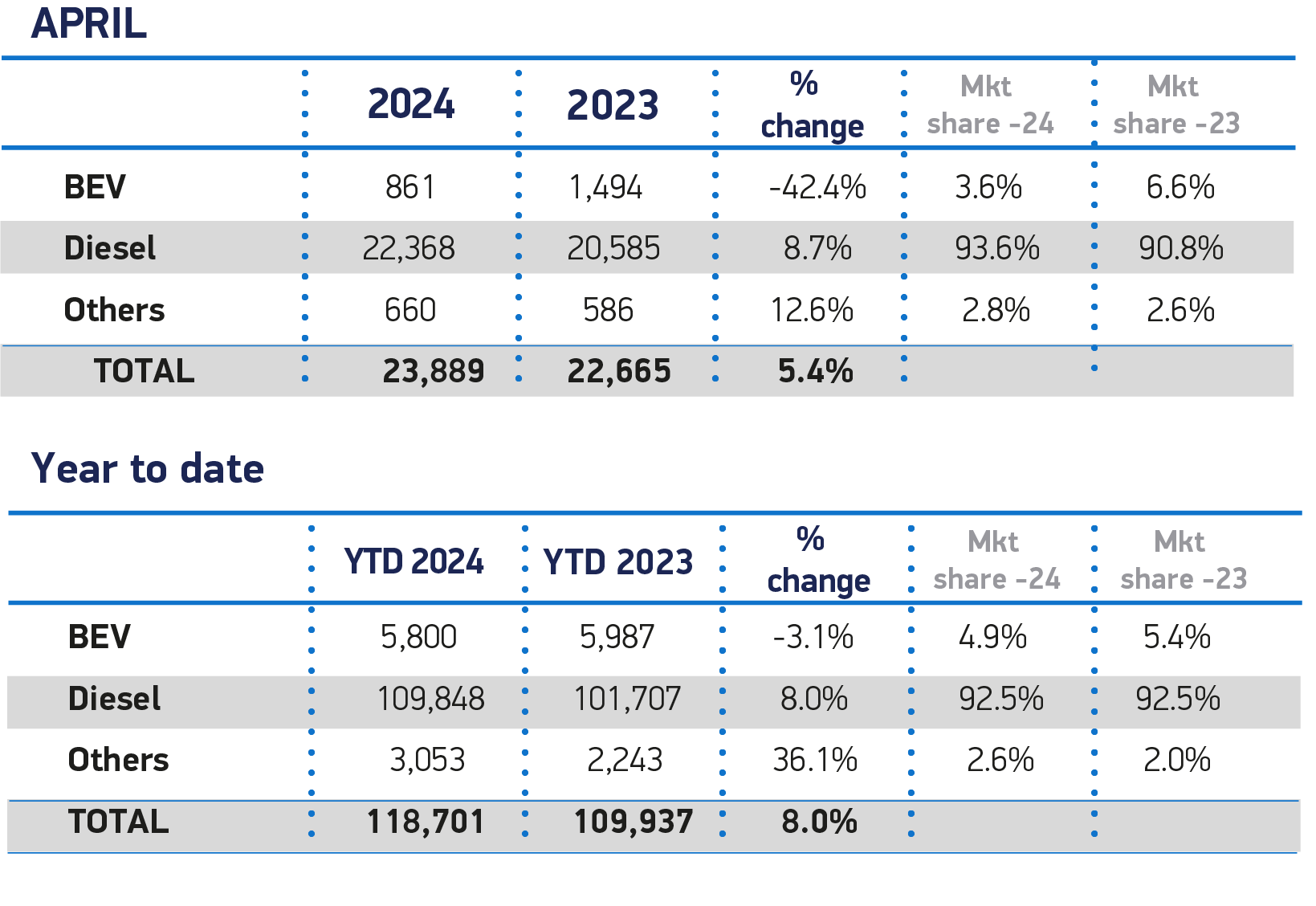

Deliveries of the latest zero-emission LCVs decreased last month, with the uptake of new battery electric vans (BEVs) plummeting to 861 units, a decline of -42.4% when compared to last year’s surge in demand. This resulted in BEVs accounting for merely 3.6% of all new LCV registrations, in contrast to 6.6% in April last year. Although it is typical for registration volumes to be low in this month following the introduction of new plates in March, the downturn in BEV adoption – precisely when government targets anticipate rapid growth – jeopardizes environmental aspirations.

The latest market forecast by the industry anticipates a 3.3% increase in the UK’s new van market to 353,000 units this year, while the BEV market share has been adjusted to 8.3%, down from 9.4% in the January projection. BEV volumes are forecasted to climb by 44.1% in 2024 to 29,000 units, yet adoption is expected to linger below the ambitious sales targets outlined for manufacturers in the Vehicle Emissions Trading Scheme (VETS). Manufacturers are persisting in their investments to introduce more zero-emission models with competitive ranges, enhanced payloads, noiseless operation, and heightened comfort levels. Nevertheless, on their own, they are incapable of propelling Britain towards its environmental goals. Although some flexibilities within the initial years of VETS may provide assistance, the absence of suitable public charging infrastructure for vans remains a substantial hurdle hindering the transition to zero-emission fleet operations.

Hence, the decarbonization of the sector hinges on a nationally coordinated, locally implemented chargepoint strategy tailored to meet the specific requirements of vans – especially the larger models for which the existing infrastructure is generally unsuitable. Identifying optimal locations for these chargepoints and hastening grid connections nationwide are crucial to instill confidence in operators to invest. Given the current imperative to cultivate conducive conditions for more fleets to transition, the retention of the Plug-in Van Grant is imperative; otherwise, the UK risks impeding the progress of road decarbonization.

Mike Hawes, SMMT Chief Executive, remarked,

The new van market in Britain is continuing to expand with the latest, more economical models driving down CO2 emissions – a primary objective for the sector. Manufacturers are funneling substantial investments to introduce electric vehicles into the market; however, the pace of adoption is decelerating, necessitating prompt action. If the government is earnest about fulfilling its ambitious objectives, it must devise an equally audacious strategy for rolling out van-friendly public chargepoints across the UK, paramount for ushering a greener era in Britain.

SOURCE: SMMT

[ad_2]