Swift Details Regarding the Vehicle Purchase and Vending Market

Within the peculiar era of car shopping in the summer of 2024, there come positive tidings, not-so-good tidings, and unsettling news for individuals engaged in the market. Nonetheless, after digesting all the information, the key lesson learned remains timeless: conduct thorough research and refrain from hastening major financial decisions.

The optimistic update indicates that prices of both new and pre-owned vehicles have been gradually decreasing throughout most of the year. Conversely, the unfavorable update points out that interest rates remain elevated and are unlikely to decline during this season. Acquiring a loan has become more challenging than usual at present, and approved loans come with increased payments due to the elevated interest rates.

Bringing in the unsettling news is a significant cyber assault that struck in June, causing disruptions and chaos in the operations of numerous car dealerships. Although their operations have now returned to normalcy, it will take a while for their inventory and record-keeping systems to recuperate. This delay might complicate the process of finding your desired vehicle this month. Car dealerships rely on specialized software known as a Dealership Management System (DMS) to oversee a multitude of tasks, from inventory tracking to service appointment scheduling and employee remuneration. The cyber onslaught in June incapacitated one of the largest DMS providers for almost a fortnight.

Dealerships resorted to slower manual procedures involving paper and pen to finalize sales transactions. While the computer system is functional once more, efforts are underway to reconcile the records pertaining to the transactions that occurred during the downtime, alongside the ongoing new sales. Dealers require time to precisely ascertain the remaining vehicles in their inventory.

In usual circumstances, dealers slash prices when faced with an excess supply of vehicles. However, due to some dealers lacking up-to-date records necessary for making such decisions, certain challenges persist. This situation is improving gradually, yet it might pose difficulties in locating the exact combination of colors and features you desire in a vehicle this month.

We shall guide you through the projected occurrences when either purchasing a new or pre-owned vehicle, or trading in your current one. Many vehicle shoppers find themselves concurrently navigating both markets, intending to exchange their current vehicle. They are likely to encounter balanced offers for their trade-ins this month. Read on to unearth more insights.

Anticipated Experiences for New Vehicle Shoppers

The pricing dynamics of vehicles in America are primarily dictated by the fundamental principles of supply and demand. In scenarios where dealers overstock, they resort to markdowns to allure buyers. On the flip side, when inventory is scarce, dealers can inflate prices above the manufacturer’s suggested retail price (MSRP), banking on sustained buyer interest.

The industry standard typically prescribes new car inventories to represent around 60 days’ worth of sales—an equilibrium point for dealers. Maintaining an inventory that aligns with the industry benchmarks prevents overspending on stagnant inventory.

Prior to the cyber incident, the prevailing industry average was approximately 74 days of inventory. However, the disruption in recordkeeping has muddied the waters, complicating estimates for July.

The prices of new vehicles have largely remained resilient amidst the chaos. In June, the average expenditure for a new car purchaser stood at $48,644—merely $266 higher than the preceding month and $307 lower than the corresponding period in 2023. Discounts accounted for 6.4% of the average transaction.

These figures are projected to exhibit stability in July, albeit influenced by the specific vehicle under consideration. Brands like Toyota, Lexus, and Honda are currently experiencing shortages, with most sales occurring near the MSRP.

Conversely, Stellantis, the parent company overseeing brands such as Alfa Romeo, Chrysler, Dodge, Fiat, Jeep, and Ram, has been grappling with twice the optimal inventory levels for the better part of the year. As a consequence, these dealers have resorted to aggressive markdowns.

It is plausible to encounter discrepancies where vehicles advertised on dealers’ websites might not be physically available this month. Dealers may continue to address the repercussions of the cyber intrusion well into late summer.

RELATED: When Should Anticipate A Drop in New Vehicle Prices?

The escalating costs of new vehicles are compounded by two significant factors: car insurance premiums and auto loans.

Despite the downtrend in new vehicle pricing, there has been a marked upsurge in car insurance costs. Car insurance premiums have seen a notable rise lately.

increased significantly over the past year that we recommend shoppers to obtain insurance estimates for any potential vehicle before committing financially. The expenses for insurance might prompt a reconsideration of the choice of vehicle.

On the other hand, while it is simple to find a reasonable deal on a quality car this month, securing a favorable car loan is proving to be quite challenging.

Potential Drop in Interest Rates Later This Year

The pricing of a new vehicle remains reasonably affordable this month, but the associated borrowing expenses are not budget-friendly.

The Federal Reserve, often referred to as the “Fed,” establishes the interest rate utilized by banks for interbank lending. This Fed rate regulates interest rates for all types of loans, including car loans. To combat inflation, the Fed raised rates last year and projected a reduction this year if successful, which has not happened swiftly.

Therefore, rates are being maintained at high levels. Initially, the Fed had planned multiple rate reductions in the early months of this year. Currently, they are predicting only one cut, not before September. Given that most buyers would finance a new car purchase, the elevated rate results in higher monthly expenses for new cars.

In June, the average consumer committed to spending the equivalent of 37.2 weeks of earnings on a new car. Lenders have also toughened their criteria, making it more challenging to qualify for a new car loan.

Despite this, interest rates are limiting the options for many buyers. The majority of buyers do not pay in cash. Those intending to finance their next vehicle would potentially benefit from waiting for the next rate adjustment.

Prospects for Used Car Shoppers

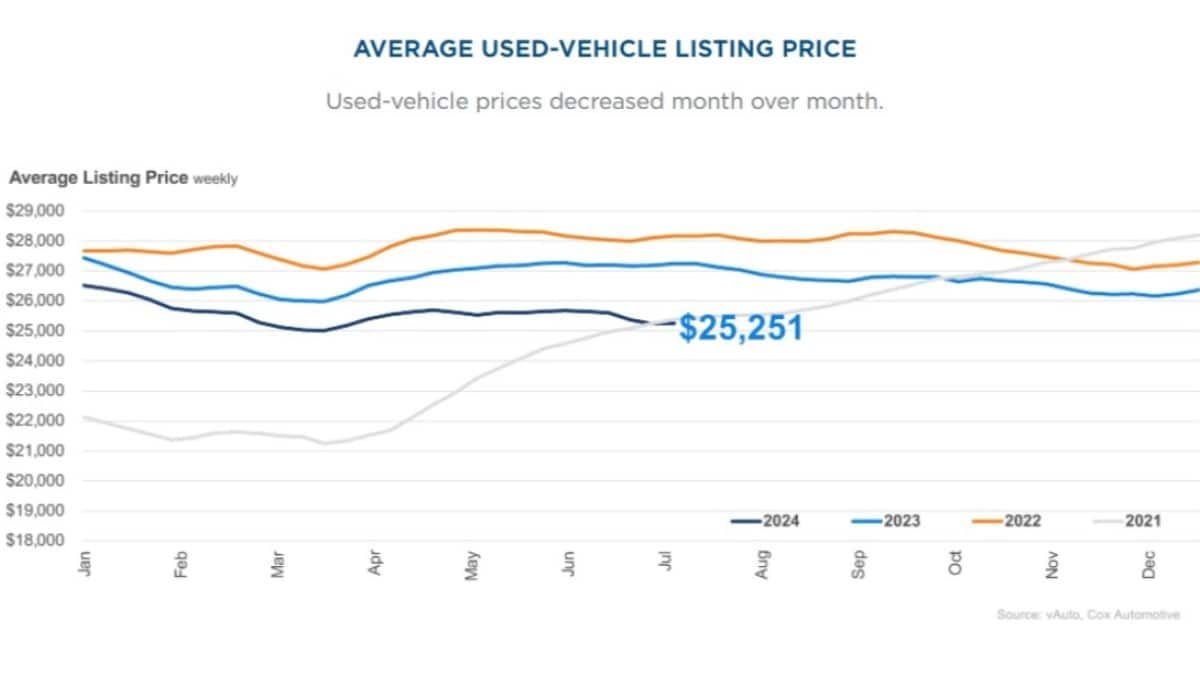

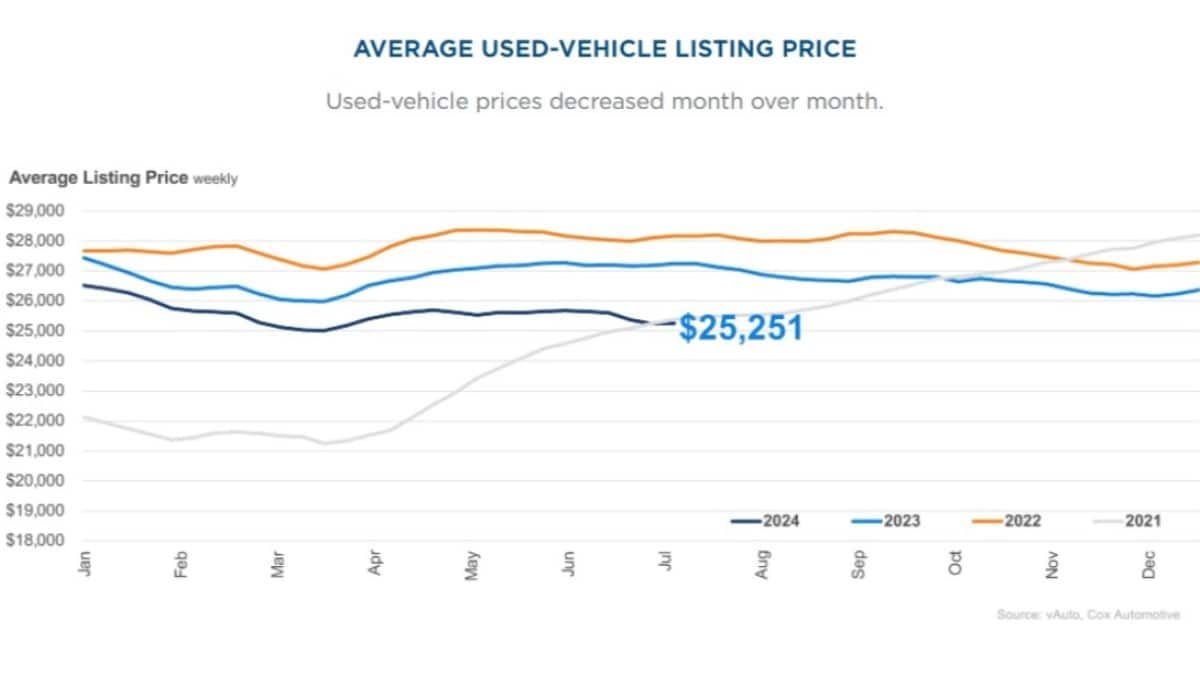

The prices of used cars are decreasing. The typical used car was advertised for $25,251 in June, showing a decrease of around $400 from May and over $1,700 from the previous June.

However, this downward trend may not be prolonged — wholesale prices that dealers pay for used cars at auctions, later selling them, witnessed a slight escalation during the month. Typically, shifts in wholesale prices translate to retail price adjustments six to eight weeks later, indicating a potential increment by late summer.

The cyberattack also impacted the inventory handling of used vehicles at some dealerships. Shoppers should be prepared for potential challenges in monitoring the availability of used cars this month. Nevertheless, this issue is expected to diminish as dealerships catch up with updating their systems post the disruption.

The national supply of used cars is projected to remain scarce for an extended period. Disruptions during the pandemic resulted in automakers producing approximately 8 million fewer vehicles in 2021 and 2022. This substantial decrease in new cars available will sustain a low inventory of used cars for years.

Given the high interest rates deterring many buyers, dealerships are currently pricing vehicles reasonably.

This month, the only challenge that used car shoppers may encounter is the limited availability of older, high-mileage vehicles that dealers usually sell for under $15,000. This scarcity has lingered throughout most of 2024 and is not expected to change this year.

Automakers Shifting to Luxury Vehicle Production

Despite potential short-term declines in new car pricing, automakers are concentrating on developing upscale vehicles. The era of budget-friendly vehicles is gradually fading away. Recent studies indicate that the sale of automobiles priced at $25,000 and below has plummeted by 78% in the past five years. Initially36 novel models in that cost range. This year, the count stands at merely 10. Simultaneously, those that are valued at $60,000 or above have surged by 163% over the same duration.

The Chief Economist at Cox Automotive, Jonathan Smoke, elucidates that the interest rate hikes imposed by the Federal Reserve last year dissuaded some buyers from investing in vehicles. Smoke warns, “This pattern prompts car manufacturers to concentrate on lucrative products for purchasers who have the means to make a purchase, thereby excluding less affluent consumers from the new vehicle market entirely and restricting possibilities in the used market for years to come.” Cox Automotive is the parent company of Kelley Blue Book.

Retailers are resisting, informing car manufacturers of their need for more budget-friendly vehicles to vend. Nonetheless, rectifying this issue will necessitate time. It is probable that budget-friendly cars will be scarce on numerous sales premises.

Finding Older, More Economical Cars Has Become Challenging

The most accessible used cars are priced between $15,000 and $30,000.

Strategies for Purchasing a Car Immediately

If you are in the market for a new or pre-owned vehicle, buyers are still experiencing shock at the price tags. Fresh vehicle prices have remained approximately 13% above those of three years ago when the median transaction price for new vehicles was approximately $42,200. Nevertheless, bear in mind that your next vehicle will likely have an extended lifespan and aid you in driving more safely than ever before with the multitude of technological advancements and offerings.

RELATED: Investing in Older, Pre-Owned Vehicles in 2024

Various studies on vehicle quality consistently reveal that contemporary new vehicles encounter fewer malfunctions than those from just a few years prior. Those who purchase slightly pricier pre-owned vehicles will probably witness these vehicles on the roads for more prolonged periods. The same principle applies to new car buyers.

With the majority of automakers now manufacturing such resilient vehicles, they vie by integrating more cutting-edge features. Attributes such as adaptive cruise control and Apple CarPlay are now more prevalent than ever on basic vehicles. Peruse below to read our pointers on purchasing a vehicle.

Optimizing Incentives for Acquiring a New Car

In June, car incentives constituted 6.4% of the average transaction, equivalent to $3,100, a decline from 6.7% in May. To capitalize on incentives, peruse our monthly best car deals to find dealer or manufacturer incentives, encompassing cash rebates and lowered interest rates for financing your next vehicle.

RELATED: Steps for Acquiring a New Car in 10 Phases

Vending Your Car at Present

Scarcely any of us are able to part ways with a vehicle without necessitating a replacement.However, if that’s your situation, why are you hesitating? You have the potential to secure a higher price for your vehicle if there is a strong demand for it, and that’s fantastic news. To maximize the profit from your pre-owned car, the most effective approach is to opt for a private sale. Alternatively, if you prefer a hassle-free process, you still have the option to sell it to a dealership.

TOP TIP: When contemplating the sale of a car, consider the option of selling it peer-to-peer via the Kelley Blue Book’s Private Seller Exchange marketplace. This cost-effective method enables consumers to fetch a higher price for their vehicle compared to selling it to a dealership.

Present Opportunities for Trading in Your Car

The continued scarcity of used cars is anticipated to persist for several years. Consequently, you can anticipate receiving attractive offers for your used vehicle this month.

“The reduction in the production of new vehicles in 2021 led to a decrease in leasing, resulting in fewer lease maturities starting this year,” quoted Jeremy Robb, the Senior Director of Economic and Industry Insights at Cox Automotive. Following two years of decline, the supply of used vehicles is anticipated to improve in the latter part of 2024; however, this improvement is not likely to be significantly aided by off-lease supply.”

It’s advisable to scout for a fair price for your trade-in by exploring different options. Each dealership strives to maintain a balanced inventory of vehicles on its lot. At times, the dealership you wish to make a purchase from may not require your trade-in urgently, while a competing dealership might.

Conduct research on the value of your vehicle using Kelley Blue Book, then reach out to several local dealerships to assess the offers they can provide. Alternatively, try our Instant Cash Offer tool, which facilitates receiving offers from various dealerships without any commitment. You can either select the offer you prefer or utilize it as a negotiation tool with other dealerships.

Future Prospects

According to the Vehicle Affordability Index collated by Cox Automotive/Moody’s Analytics, the affordability of new vehicles witnessed an improvement throughout the previous year, a trend that is expected to continue in 2024.

However, prospective car buyers can look forward to a better second half of 2024, as any potential reduction in interest rates could bolster affordability. If the Federal Reserve opts to lower rates this year, alleviating inflation could bring relief to car buyers.

RELATED: Discover the 10 Best Used Car Deals

Guidance for Vehicle Purchase Right Now

Should you decide to embark on your search now, we suggest some strategies to assist you in finding the perfect new or used car that aligns with your budget.

- Broaden your search. Extend your search to a larger geographic region.

- Exercise patience. Contact dealerships promptly and regularly to inquire about incoming supplies of the harder-to-find vehicles. Secure your priority spot by placing a refundable deposit.

- Consider a more affordable model. With the uptick in car loan interest rates, contemplate purchasing a cheaper model instead of a pricier one within the lineup you’re targeting.

- Time your decisions. Be prepared to assess multiple offers and be willing to engage with various dealerships as you search for the ideal match.

- Don’t rush. Devote as much effort to exploring options for your trade-in as you do to finding the right vehicle. Avoid accepting the initial offer as it might undervalue your vehicle.

- Evaluate choices. Besides focusing on the vehicle, hunt for the most favorable interest rates from banks or credit unions. Prior to finalizing the deal, compare insurance rates to estimate the elevated costs of auto insurance for your desired vehicle. Deliberate over all options available, including financing perks and dealership deals, if that’s where you intend to make your purchase. You might even discover that the price discrepancies between certain new models of used vehicles are comparable to those of new cars. Thus, maintain an open mind during your quest.

- Avoid paying excessive dealer charges. Should you encounter a surcharge, commonly labeled as a market adjustment, on your ultimate bill, request its removal or consider exploring alternative dealerships.

- Scrutinize additional extras. Review your sales breakdown for any unsolicited additions such as “window tint” or “fabric protection.” If present, request the removal of these items from your invoice, as dealers often append them to boost their profits quickly.

Retaining your current vehicle for another year may be a wise decision. However, if the situation demands a purchase, be sure to maintain meticulous care of your new vehicle to ensure its longevity.

More Articles on Buying and Selling Vehicles:

Note: This article has been revised since its original publication.

[ad_2]