[ad_1]

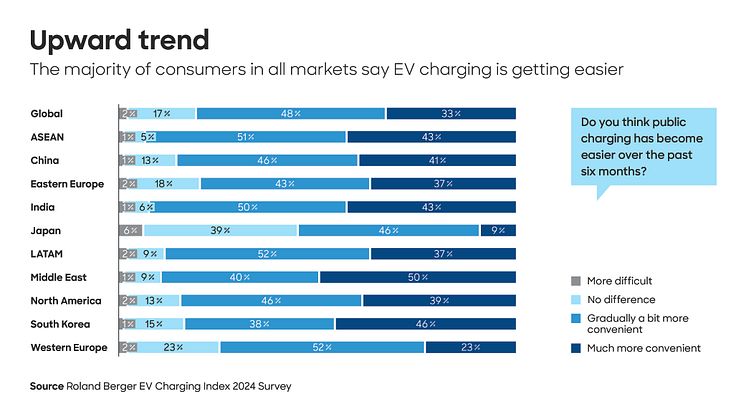

Following a period of rapid expansion, there was a slowdown in the growth of electric vehicle (EV) purchases in 2023. The worldwide sales of EVs surged by 33% in 2023, a significant decline from the over 100% growth seen in 2022. The average percentage of EVs in new vehicle registrations continues to climb – up by 20% from 14% in 2022 – although certain established markets such as South Korea and Germany observed a drop in this aspect. The industry is currently encountering various challenges, including soaring electricity prices, inflation, and reduced incentives as governments shift their financial focus from vehicles to charging infrastructure. The growth in the number of charging stations was robust in 2023, increasing by 65%, with most regions witnessing a minor decrease in the overall vehicle-to-charger ratios. As a result, 81% of consumers claim that the process of charging EVs has become more convenient in the last six months. A substantial rise in the proportion of rapid chargers has been instrumental in this improvement. These are the primary outcomes of the Roland Berger EV Charging Index 2024, which draws from extensive industry discussions and a survey of 16,000 respondents in markets spanning Europe, Asia, North and South America, and the Middle East – evaluating their readiness in charging infrastructure and consumer satisfaction amidst the general trends in EVs.

“The global electric mobility scenario showcases a diverse panorama. Developed markets are reducing or eliminating incentives for EVs, whereas less mature markets, such as those in southern Europe, are now emphasizing the expansion of infrastructure and EV sales,” remarked Adam Healy, Principal at Roland Berger. “Varied strategies from original equipment manufacturers (OEMs) also come into play – some automotive companies are committing anew to fresh fully electric platforms, while others are transitioning to plug-in hybrids. The sluggish progress towards cost parity between traditional internal combustion engine vehicles and EVs adds further complexity to the situation.”

China emerges as the leading champion in electric mobility once again

Although China’s overall rating in the Index did not show a surge in 2023, its supremacy at the top of the rankings remained unscathed due to its consistent growth in EV sales and charging infrastructure. On the contrary, its closest rivals – Germany, the United States, and the Netherlands – experienced either stagnant or declining scores, a trend mirrored across most well-established markets in 2023. Meanwhile, evolving markets in the Middle East and Southeast Asia are witnessing rapid growth in EV sales, bridging the gap with the leading nations.

The United States clinched a joint second position in the most recent edition of the EV Charging Index, bolstered by the sustained growth in EV sales in 2023, including the rising popularity of plug-in hybrids. However, the expansion of public charging infrastructure did not keep pace, although the considerably high proportion of US EV owners possessing home charging capabilities lessens the reliance on public charging facilities. Additionally, the continuous federal support for electric mobility heavily hinges on the outcome of the US elections in November 2024.

OEMs escalate their involvement in charging amenities to stimulate EV sales

The EV charging sector is thriving, with a myriad of new entrants making their presence felt in both developed and emerging regions. Across the globe, OEMs are enhancing their participation in charging services, either through their exclusive branded networks or via collaborations in consortia. This trend is especially noticeable in nascent markets where they can bolster EV sales through infrastructure expansion.

“Investments related to charging are gaining popularity globally, and market participants are continuously exploring new business models and technologies,” remarked Jack Zhuang, Principal at Roland Berger. “Ultimately, various solutions are expected to be pertinent for diverse usage scenarios.

SOURCE: Roland Berger

[ad_2]