[ad_1]

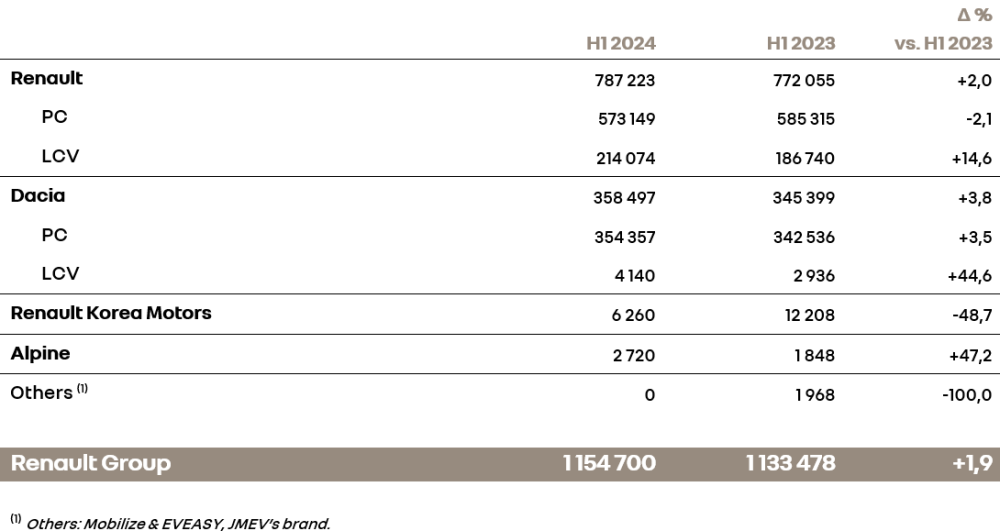

- By following a successful approach in Europe[1] (+6.7%), Renault Group maintains an upwards trend in its overall sales during the first half of the year (+1.9%) reaching 1,154,700 vehicles sold.

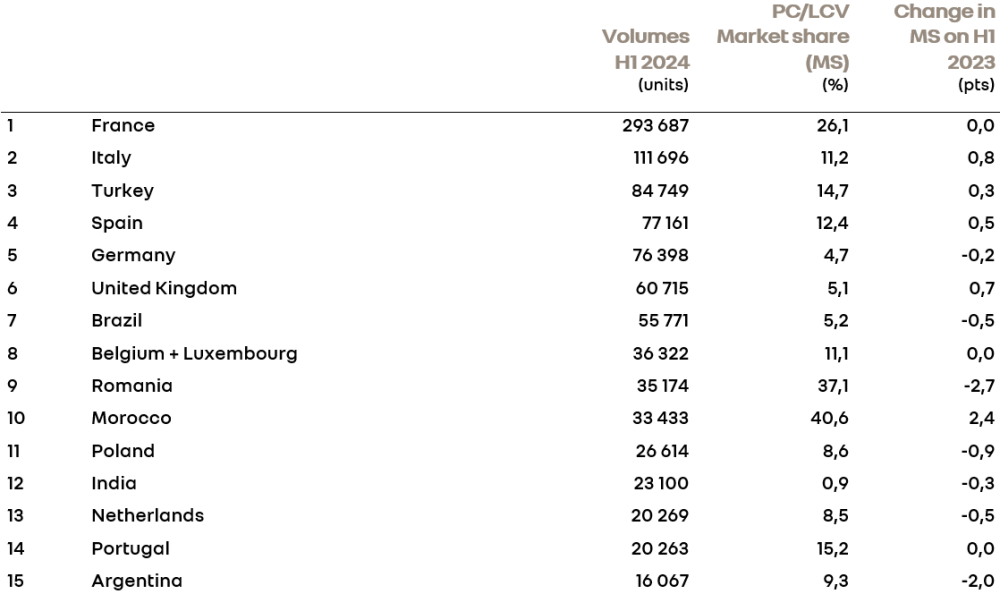

- Within Europe, the Group solidified its third position, achieving sales of 847,623 vehicles, a growth of 6.7% in a market that expanded by 5.5%.

- The Renault marque is surpassing the market with 535,238 vehicles sold, a surge of 8.2% in a market that grew by 5.5%, positioning it as the third best-selling brand in Europe and the leader in France (PC+LCV). The rise in car sales is a result of the outstanding performance of full hybrid E-Tech engines (+45% vs. H1 2023). In the realm of light commercial vehicles, Renault retains its leading position[2] with 171,202 sales (+19.2% vs. H1 2023).

- The Dacia brand recorded 309,816 vehicle sales, a hike of 4.0% from H1 2023, maintaining its standing among the top 10 best-selling brands in Europe. The Sandero model holds the top spot as the best-selling car across all distribution channels.

- The Alpine brand documented 2,569 registrations in the first half of 2024, a boost of 47.7% vs. H1 2023, fueled by the triumph of its expanded line-up featuring the A110 R Turini.

- An established commercial strategy: a beneficial blend and distribution channels.

- Retail transactions constituted nearly 62% of the total volume of vehicles sold across the Group’s primary five European markets[3], exceeding the market average by over 20 points. The Group boasts four vehicles[4] in the top 10 rankings of retail sales in Europe.

- At the C segment and beyond, specifically C-SUV and D-SUV (+10%), the Renault brand is gaining momentum, primarily propelled by Austral and Espace E-Tech full hybrids, notably the higher-trim variants receiving positive customer feedback.

- Electrified models represented 29.6% of Renault Group’s sales in Europe (+4.3 points vs. 2023). This progression was predominantly driven by the popularity of hybrid powertrains, witnessing a substantial sales surge (+59.6% compared to the first half of 2023).

- Almost half of the Renault brand’s car sales are electrified, thanks to the remarkable reception of its hybrid engines. Renault ranks as Europe’s second most popular brand in the hybrid passenger car category, with Clio, Austral, and Captur securing positions in the top 10.

- All-electric vehicles contributed to approximately 12% of Renault brand sales and are anticipated to grow further in the latter half of the year with the introduction of the Scenic E-Tech Electric and Renault 5 E-Tech Electric.

- Approximately 10% of Dacia brand sales are tied to electrified vehicles, particularly fueled by the success of the Jogger Hybrid 140.

- Alpine initiated its electric campaign with the unveiling of the A290, its premier all-electric hot hatch, on June 13, 2024. Orders are set to commence this summer.

- The European order book of the Group reflects 2.6 months of projected sales by the end of June 2024.

- With ten new commercial debuts[5] scheduled for 2024, Renault Group remains committed to its electrification thrust and global market expansion.

Renault brand

The most popular French automotive brand globally

The Renault brand witnessed a 2.0% sales uptick (787,223 vehicles) in the first half of 2024 compared to the corresponding period in 2023, propelled by its success in Europe, where sales escalated by 8.2% (535,238 vehicles). Outperforming a market growth of 5.5%, the brand solidified its standing as Europe’s third-leading PC+LCV brand, primarily supported by achievements in Spain (+12.7%), Italy (+18.4%), and the United Kingdom (+32.7%).

In its domestic French market, Renault reaffirmed its dominant position with 214,881 units sold, a growth of 8% across the overall PC+LCV sector. Nearly one in every five vehicles sold in France bears the Renault insignia.

Outside of Europe, the brand is making headway in Turkey (10.8%), Brazil (5.3%), and Morocco (1.5%). The early months of the year saw the introduction of the “International Game Plan 2027.” Renault is reintroducing the brand in South Korea with the Grand Koleos, while the Kardian is off to a promising start in Brazil with over 5,200 registrations. The model has also received favorable responses in Mexico and is slated for launch in Morocco in the second half of the year. In Turkey, Renault recently unveiled the Renault Duster, set for international market release in the latter part of the year.

A strategy focused on value: a significant portion of sales directed to end customers in Europe, coupled with a surge in the C segment and above

In the five primary European markets, the Renault brand consummates half of its sales with retail customers, tapping into a market that creates substantial value. The Clio and Captur models rank among the top 10 in retail sales rankings.

Renault is intensifying efforts in Europe to reconquer the C segment and beyond, especially in C-SUV and D-SUV (+10%), with models like Austral, Espace E-Tech Full Hybrid, and Rafale, particularly the premium variants that constitute a significant portion of sales. Over half of Austral sales and 72% of Espace E-Tech Full Hybrid sales pertain to the Iconic or Esprit Alpine versions.

Europe’s Premier LCV brand

The brand bolsters its leadership in the LCV sector[6] with 171,202 units sold, marking a 19.2% upsurge from H1 2023, in contrast to a market increase of 12.9%. This surge is fueled by the triumph of flagship models like Kangoo and Express (+30.7% vs. H1 2023), alongside Master (+16.0% vs. H1 2023), each leading in their respective segments. Simultaneously, Trafic (+22.5% vs. Y-1) now claims the position of the third best-selling vehicle in its category.

Strategic technological decisions and a two-pronged electrification approach

Nearly half of Renault’s sales are electrified. The brand continues its electrification drive with a dual strategy encompassing a comprehensive electric vehicle range and a complete hybrid lineup.

Renault holds the second spot in Europe’s hybrid market, with more than one in three sales attributed to hybrids, witnessing a remarkable surge in sales (nearly +45% compared to H1 2023). Models like Clio, Austral, and Captur rank among the top 10 best-selling hybrids.

All-electric vehicles represent almost 12% of Renault’s sales and are set to expand further with models like Scenic E-Tech Electric and Renault 5 E-Tech Electric. The Megane E-Tech Electric, launched in mid-2022, ranks among the top 3 in its class in Europe.

2024: A plethora of market introductions for the Renault brand

With seven new models on the horizon, 2024 promises to be a fruitful year for commercial launches at Renault. The brand has a promising start to the year while anticipating the release of Symbioz, Master, and Renault 5 E-Tech Electric in Europe. Internationally, the brand will persist in expanding its market presence.It’s the “Global Strategy” featuring the debuts of Renault Duster and Grand Koleos in the market, while Kardian is set to enter new territories.

Dacia label

Uninterrupted advancement

The sales of Dacia rose by 3.8% in the initial six months of the year, totaling 358,497 registrations. Throughout Europe, Dacia sold 309,816 vehicles, marking a 4.0% increase PC+LCV. The brand holds the ninth position in the PC market and continues to be among the top 10 for PC+LCV sales in Europe.

Outcomes attributable to a robust new brand persona

Buoyed by a robust new brand persona, Dacia is solidifying its standing in the European retail sales podium by focusing on the brand’s core customer base, featuring four key models and high conquest and loyalty rates compared to the market average.

The global sales of Dacia Sandero reached 164,789 units, surging by 18.5% in the first half of 2023. As the best-selling retail vehicle since 2017, Sandero also holds the top position as the best-seller in Europe across all customer segments in the initial six months of 2024.

With 113,783 units being sold globally, the sales of Dacia Duster (including the second and recently introduced third generation) increased by 1.7% compared to the first half of 2023. The model continues to be among the top performers in SUV retail sales in Europe.

Dacia Jogger registered sales of 50,841 units globally, reflecting a 0.7% increase from the first half of 2023. It stands as the best-selling non-SUV C-segment vehicle in Europe for retail sales.

The sales of Dacia Spring are dwindling due to alterations in government incentives and the product’s life cycle. Nevertheless, in the initial half of 2024, Spring secured the fifth position in retail sales of compact electric vehicles (A and B segments) in Europe.

Revamp of the lineup

The latest iteration of Dacia Duster, which has been open for ordering since mid-March 2024, is now available in showrooms since June 2024. The model has been positively received and has already clinched numerous accolades across various markets.

The all-electric New Spring has been open for orders since April 2024 for mainland Europe and since June 2024 for the UK. It is slated to hit the showrooms in the autumn of 2024.

In the latter half of 2024, the brand will introduce Bigster, its upcoming C-segment SUV, anticipated to be available at dealerships in the first half of 2025.

Alpine category

Brand achievements

Alpine achieved a record-breaking 2,720 registrations, marking a 47.2% surge compared to the first half of 2023, primarily driven by strong performances in France (+58.9%), Germany (+45.9%), the UK (+27.2%), and Belgium (+29.5%).

Commencement of the electric onslaught:

In June, Alpine initiated its electric assault with the unveiling of A290, the brand’s dynamic electric 5-seater hatchback, at the Le Mans 24 Hour event. Orders are set to commence this summer.

Accelerated global expansion:

Internationally, the initial half of 2024 witnessed the expansion of Alpine into the Turkish market and the inauguration of the inaugural Atelier Alpine in Barcelona, an immersive concept store that will soon make its way to London and Paris. By the conclusion of 2024, the brand aims to launch new Alpine stores in the Netherlands, Hungary, and Sweden, in addition to locations in France (including Guadeloupe).

Renault Group global sales by trademarks

Renault Group’s top 15 territories

[1] Scope: ACEA Europe

[2] Excluding pick-up vehicle models

[3] France, Italy, Germany, Spain, United Kingdom

[4] Sandero, Duster, Clio, Captur

[5] 10 fresh vehicle debuts in 2024 excluding Renault Duster (outside Europe) and Captur facelift version

[6] Excluding pickup trucks

SOURCE: Renault Group

[ad_2]