[ad_1]

- Impressive Increase in Profitability in the First Half of 2024:

- Total Group earnings: €27.0bn, up by 0.4% and a significant 3.7% increase compared to the same period in 2023 when considering constant exchange rates[1]

- Revenue from Automotive sector: €24.4bn, a slight decrease of 1.9% but showing a positive growth of 1.2% versus the first half of 2023 at constant exchange rates[1]

- Unprecedented Profit Margins:

- Group operating profit margin: 8.1% of revenue (increase of 0.5 points compared to the first half of 2023), a rise of €0.1bn from 2023 H1

- Automotive operating margin: 6.6% of revenue (up by 0.4 points from the first half of 2023)

- Net earnings: €1.4bn (which includes €440m from capital loss on Nissan shares disposal)

- Sturdy free cash flow: €1.3bn driven by robust operational performance, consisting of a €600m dividend from Mobilize Financial Services and a negative working capital change of €209m

- Unbeaten net cash position in the automotive sector: €4.9bn as of June 30, 2024 (an increase of €1.1bn compared to December 31, 2023)

- Expanding and Complementary Automotive Brands:

- Renault brand ranks #3 in Europe, #1 in France, and leads in LCVs[2]

- Dacia among the top 10 best-selling brands in Europe, with Sandero being the highest-selling car across all channels

- Alpine experiences robust double-digit growth prior to new product launches

- Strong Order Book in Europe standing at 2.6 months of forward sales, indicating exceptional order reception

- Healthy Total Inventory Level of 500ku as of June 30, 2024 (a decrease of 69ku year over year)

- Renault Group reaffirms its financial projections for 2024:

- Targeting a Group operating margin of at least 7.5%

- Aim for a free cash flow exceeding €2.5bn

“These remarkable outcomes are the result of substantial efforts undertaken by the hard-working teams at Renault Group over recent years. Our focus on cost reduction and value-centric commercial strategies is mirrored in our latest lineup, the most impressive one in the company’s history. Along with traditional performance enhancement methods, we have revived the innovative spirit that characterized our golden era. For the past few months, we have accelerated our transformation to position ourselves as the most forward-thinking European automotive company. With a streamlined structure consisting of 5 targeted business areas, an integrated and interconnected approach, enhanced supply chain, optimized processes (through the “speed of lightness” program), deployment of AI at all levels and stages of our operations, these elements form the essence of Renault’s new winning formula. The core drivers of flexibility, agility, and innovation continue to steer our performance enhancement efforts and effective capital management. Most importantly, the dedicated individuals at Renault Group are fully invested in driving this transformation forward. It is this passion that fuels sustained value creation for all our stakeholders,” expressed Luca de Meo, Chief Executive Officer of Renault Group

Financial Highlights

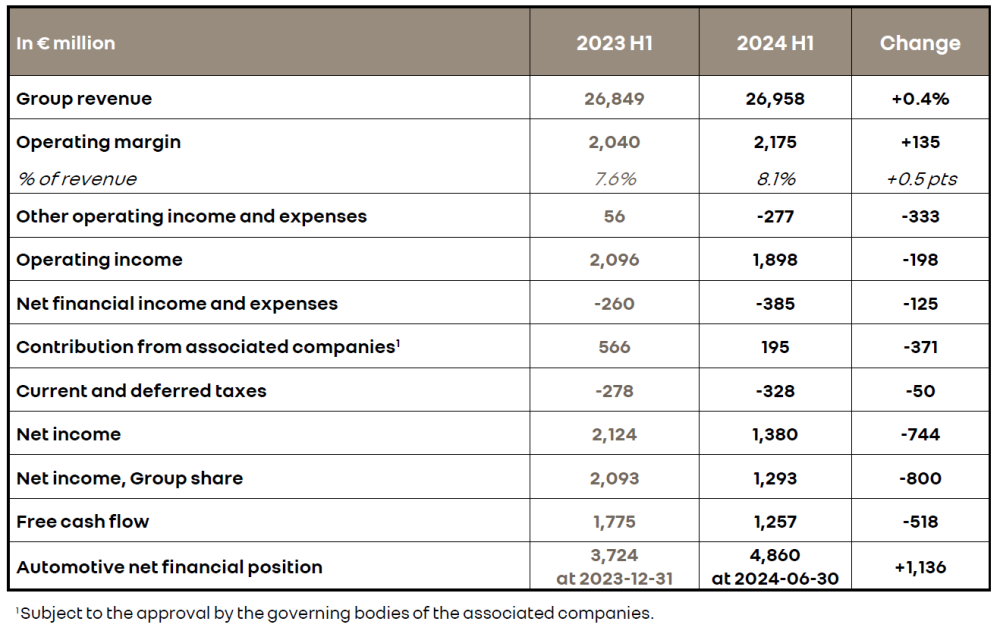

Group revenue surged to €26,958 million, showcasing a 0.4% uptick compared to the first half of 2023. At constant exchange rates[3], this represented a solid 3.7% growth.

Automotive revenue amounted to €24,372 million, down by 1.9% compared to the corresponding period in 2023. This decline included a 3.1-point impact of adverse exchange rates (-€779 million), primarily attributable to the devaluation of the Argentinean peso and, to a lesser extent, the Turkish lira. However, at constant exchange rates1, the revenue saw a positive increase of +1.2%. The following factors played a significant role in this evolution:

- A price effect of +1.8 points, primarily aimed at offsetting currency devaluations, especially in Argentina and Turkey. Renault Group has initiated a phase of price stability along with targeted product repositioning, enabled by cost efficiencies.

- A positive product mix effect of +1.0 point, reflecting continuous enhancement in line with the recent product launches by the Group (Scenic, Rafale, and Espace). This effect more than mitigated the negative impact from the discontinuation of Zoe and the sustained success of Sandero. This positive trend is expected to further improve in the forthcoming quarters.

- A favourable geographic mix effect of +1.1 points, largely driven by the Group’s European operations.

- A negative volume effect of -4.7 points. While there was a 1.9% growth in registrations, this was outweighed by destocking activities within the dealership network in the first half of 2024 compared to significant restocking in the first half of 2023.

As of June 30, 2024, total new vehicle inventories remained at a healthy level of 500,000 vehicles (a reduction of 69k units year on year), including 369,000 at independent dealers and 131,000 at the Group’s level. - A stable effect from sales to partners of +0.2 points, reflecting reduced sales of new vehicles to partners in a transitional phase before the introduction of new products, counterbalanced by R&D expenditure in line with the Group’s collaborative projects.

- A positive impact under the “Other” category of +1.8 points, attributed to robust performance in parts and accessories sales, as well as dynamic growth in used car sales.

The Group achieved a notable operating margin of 8.1% of revenue, marking an improvement from 7.6% in the first half of 2023, with an increment of 0.5 points.

Automotive operating margin stood at €1,600 million compared to €1,541 million in the first half of 2023. This represented 6.6% of Automotive revenue, a positive change of +0.4 points from the same period in 2023. The following factors contributed significantly to this progression:

- A favourable foreign exchange impact of €93 million, primarily due to the effects of Turkish lira devaluation on production costs.

- An adverse volume effect of €329 million, predominantly influenced by the aforementioned destocking activities.

- In the first half of 2024, the price/mix/enrichment effect amounted to a positive €51 million, combined with cost reductions of €262 million attributed to robust purchasing practices and, to a lesser extent, advantageous trends in raw materials. Together, this led to a positive impact of €313 million.

Renault Group continues its cost reduction efforts and passes on part of these savings to customers, thereby enhancing its competitive edge through attractive pricing and offerings while fulfilling regulatory requirements, especially for new models and facelifts. The strategic focus of Renault Group is to synergize these dual effects with the sole objective of enhancing margins. - A positive R&D impact of €153 million: the rise in gross R&D expenditures and the lower capitalization rate (-6.2 pts as compared to the first half of 2023) were more than offset by R&D billings, in alignment with the escalation of the Group’s partnerships, and reduced amortization of capitalized R&D expenses.

- An adverse impact from SG&A, leading to an increase of €109 million, mainly due to amplified marketing expenditures associated with brand initiatives and ongoing motorsport activities.

- Prior to deconsolidation, Horse was accounted under the IFRS 5 assets held for sale treatment, resulting in the suspension of asset amortization.Ever since Horse’s deconsolidation happened on the 31st of May, 2024, invoices settled with Horse by Renault Group now encompass the amortization cost once again alongside Horse’s markup. The combined impact of these two components amounted to €55 million for the month of June.

The Engagement of Mobilize Financial Services (Sales Financing) in bolstering the Group’s operational profit surged to €593 million, a €75 million increase from H1 2023, primarily attributable to the consistent robust expansion of customer financing operations and a -€37 million non-recurring adverse impact from swaps valuation in H1 2023.

Alternative income and costs in operations recorded a negative valuation of -€277 million (as against +€56 million in H1 2023) and notably comprised +€286 million in capital profit from Horse’s deconsolidation, -€440 million in capital loss from the divestment of Nissan shares in March 2024, and restructuring costs amounting to -€123 million.

Upon accounting for other income and expenses in operations, the Group’s operational profit landed at €1,898 million, as opposed to €2,096 million in H1 2023.

Net financial income and expenses totaled -€385 million, contrasting with -€260 million in H1 2023. This shift was majorly influenced by the repercussions of hyperinflation in Argentina.

The contribution from affiliated entities stood at €195 million compared to €566 million in H1 2023.

Present and postponed taxations represented a debit of -€328 million in comparison to a debit of -€278 million in H1 2023. The actual tax ratio reached 17% by the conclusion of June 2024, marking a rise of +2 percentage points in comparison to H1 2023, due to the initial year of enforcing the Pillar 2 directive and other postponed tax impacts.

As a result, the total net earnings reached €1,380 million, inclusive of the capital loss from the sale of Nissan shares.

Net earnings attributable to the Group amounted to €1,293 million (equal to €4.74 per share).

The cash flow in the Automotive sector hit €2,972 million in H1 2024, incorporating a €600 million dividend from Mobilize Financial Services.

Without accounting for asset divestments, the Group’s net CAPEX and R&D expenditure reached €2,143 million, equating to 7.9% of revenue, as opposed to 6.9% in H1 2023. Asset divestments amounted to €28 million, compared to €197 million in H1 2023. The Group’s net CAPEX and R&D accounted for 7.8% of revenue when considering asset divestments.

Operational cash flow[4] stood at €1,257 million and encompassed an adverse shift in working capital necessity of -€209 million.

The net fiscal position of the Automotive segment surged to a peak of €4,860 million by June 30, 2024, from €3,724 million by December 31, 2023, displaying an improvement of €1,136 million.

This progression was propelled by the strong operational cash flow, a positive boost from the Horse deconsolidation (+€420 million), cash inflow from Nissan shares’ sale (+€358 million), dividends received from Nissan (+€142 million). Nonetheless, it was partially counterbalanced by shareholder dividends paid out for -€628 million and monetary investments amounting to -€355 million, which incorporated -€215 million in Flexis SAS.

Available monetary reserves by the conclusion of June 2024 remained at a substantial €17.6 billion.

2024 FY financial perspective

Renault Group reaffirms its financial expectations for the 2024 FY:

- Group operational margin surpassing or equaling 7.5%

- Operational cash flow exceeding or equaling €2.5bn

Consolidated financial results of Renault Group

[1] Renault Group recalculates the revenue for the prevailing period by applying mean exchange rates from the prior period to study the variance in consolidated revenue at unchanging exchange rates.

[2] Pertaining to non-inclusion of pick-up trucks.

[3] Renault Group adjusts the revenue for the prevailing period by implementing mean exchange rates from the preceding period to assess the variation in consolidated revenue at unchanging exchange rates.

[4] Operational cash flow: cash flow post-interest and taxes (excluding dividends received from publicly listed firms) minus tangible and intangible investments net of dispositions +/- alteration in working capital necessity.

SOURCE: Renault Group

[ad_2]