[ad_1]

The tale of Daniel Lesin’s legal dilemma evolves from his apprehension by the FBI the previous year. The self-proclaimed 24-year-old “tycoon” is facing consequences after vending fraudulent reservations for the highly sought-after Ferrari Monza SP1 and SP2 in 2018 to customers across the U.S. and Canada through multiple business entities. One buyer even handed over a substantial sum for a place in line that was purely a figment of Lesin’s imagination.

Following his guilty plea for wire fraud three months ago, Lesin made his final appearance in court last Friday for sentencing.

Accused of four counts of wire fraud with a potential maximum penalty of up to two decades behind bars and a $250,000 fine, Lesin will serve a sentence of up to 45 months in a federal correctional facility, followed by three years of probation upon release.

As part of his sentencing, Lesin must forfeit any assets acquired through his deceitful earnings, which includes almost $2.3 million in cash, nearly $200,000 in luxury Ulysse-Nardin and Rolex timepieces, and a Salvador Dali artwork.

If you’re not up to speed on Lesin’s narrative, allow me to bring you up to date. Lesin was a prominent figure in the supercar scene, spinning tales about his wealth and cars—alleged oligarch lineage, affluent relatives, gambling tech, or any current fancy excuse. Stories circulated of Lesin seeking to elevate his stature by reserving upscale hotel suites to enhance his image, yet reportedly seeking discounts later on.

Members of the popular Ferrari Chat forum were skeptical of Lesin. Despite his assertions of selling a business for a substantial sum, his claims were met with doubt by some users. He managed to sway opinions and commenced listing cars for purchase on the forum. Legal files state Lesin declared his family had “collectively possessed around 75 Ferraris, establishing a strong, long-lasting rapport with Ferrari,” enabling them to undergo a customized application process to acquire a Ferrari Monza, despite allocations for the $2 million automobile being exhausted.

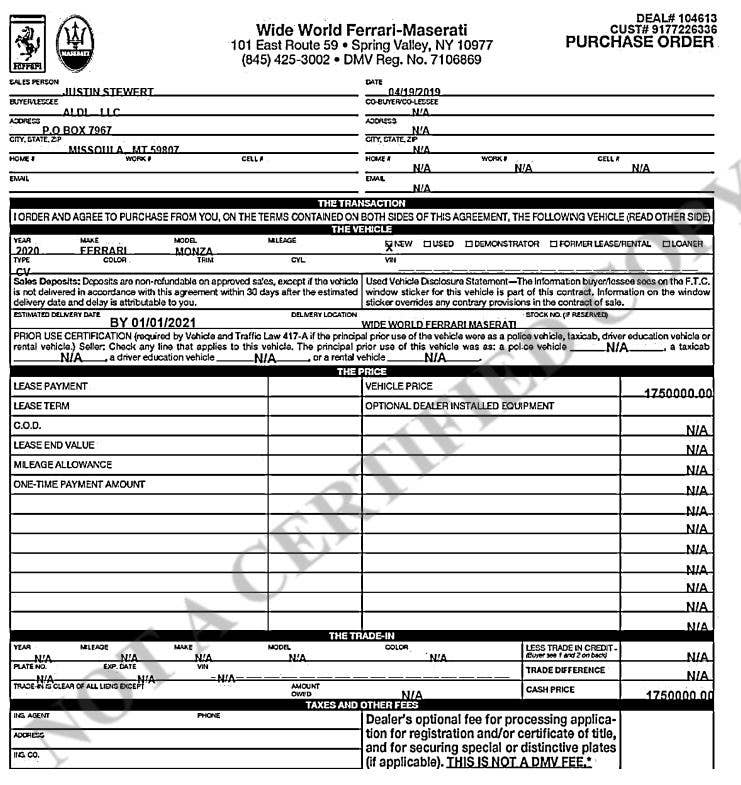

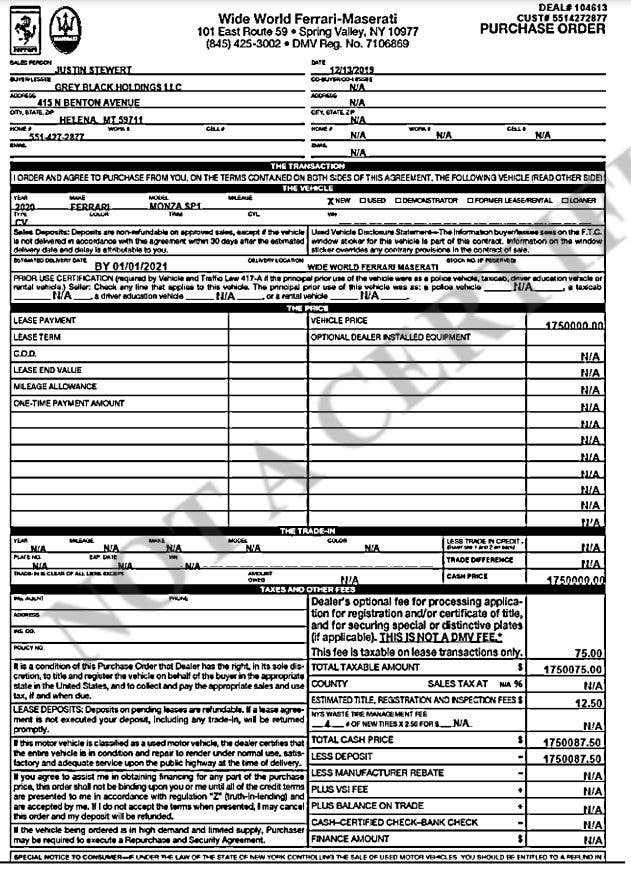

The allegations against him suggest he either bought specific Ferraris or had access to potential acquisitions under construction—but in reality, he had neither possession. Nevertheless, Lesin enticed buyers by furnishing counterfeit build sheets with fabricated purchase orders allegedly transacted using his own funds. Over four years, Lesin reportedly convinced buyers to hand over significant amounts (in the six-figure range) and wire transfers upfront, promising a vehicle, but failing to deliver.

Official documents outline at least five victims of Lesin’s deceit. One victim lost $78,355, with others facing losses at $280,000, $300,000, $612,510, and a staggering $1 million each. The total sum of traceable funds in the court proceedings amounted to $2,270,865.50.

Seemingly, one of the individuals affected is the proprietor of an automobile dealership that had intentions to trade a vehicle acquired through Lesin. According to the victim impact declaration, the deceitful scheme resulted in a loss of $800,000 in earnings for the business and eroded the trust of a loyal client.

Currently, Lesin is entangled in three active litigations in a court located in Florida. One of the lawsuits is demanding a compensation of $1.5 million linked to a deceitful acquisition of a Ferrari, while the other two are legal actions by American Express for debts surpassing $125,000.

If you have any leads or inquiries for the writer, please reach out to them directly at: rob@thedrive.com

[ad_2]