[ad_1]

In its fifth consecutive survey, the Japanese tech giant Asahi Kasei interviewed car users across the four major automotive markets to gather insights on brand loyalty and the primary drivers behind purchasing electric vehicles (EVs).

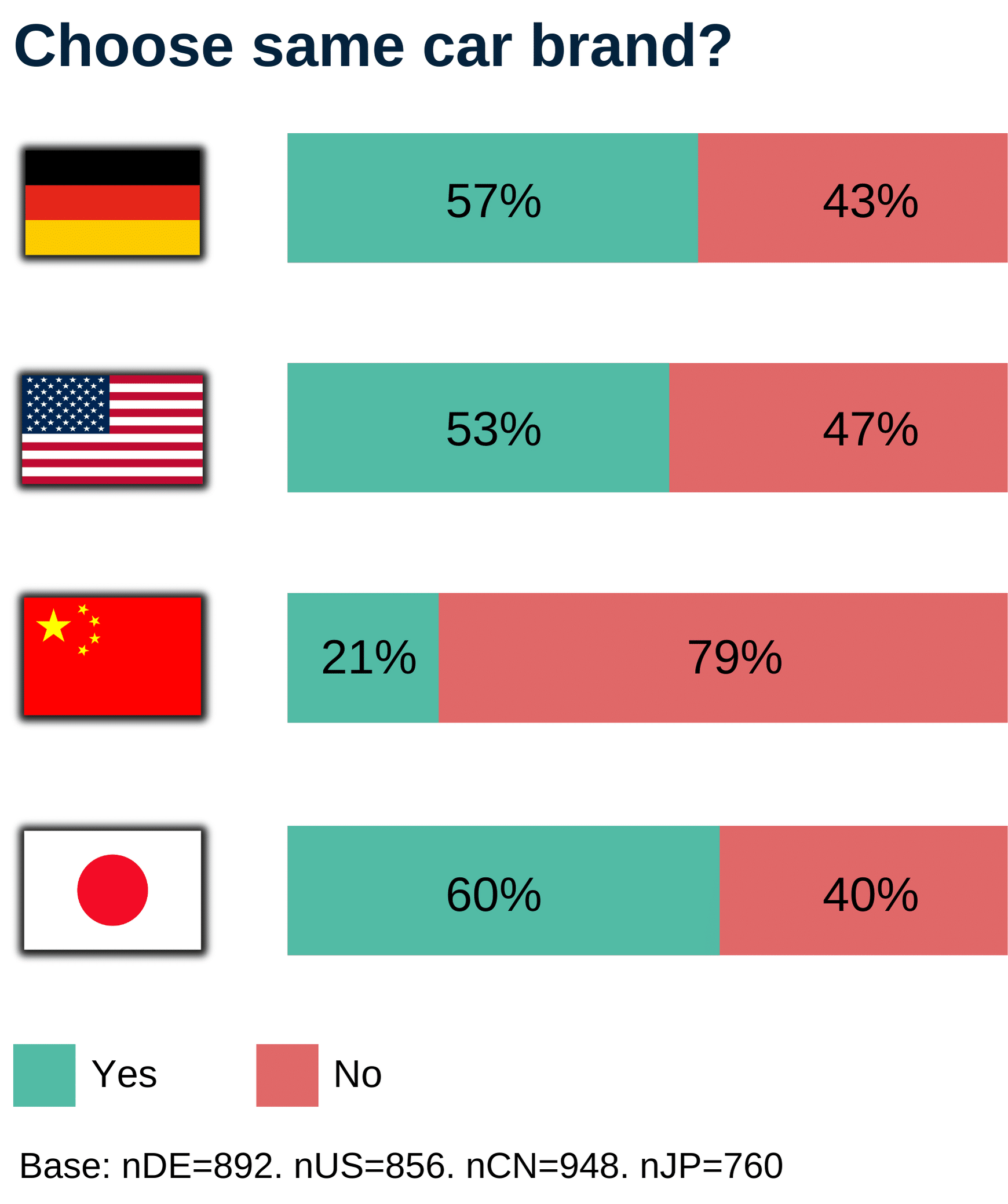

The results of this latest survey confirm an ongoing trend – with intensifying competition, emerging players, and evolving customer preferences, brand loyalty is steadily diminishing on a global scale. More than half of respondents in Germany and the USA intend to switch to a different car brand for their next purchase. In China, an astonishing 79% of individuals expressed openness to selecting a model from a different manufacturer.

Among various age groups, individuals from Generation Z (born between 1995 and 2010) exhibited the lowest levels of brand loyalty, indicating a diminishing attachment to specific brands among younger car users.

To revive brand loyalty, car manufacturers and suppliers must grasp the needs of end consumers and devise strategies to differentiate themselves in the increasingly competitive market.

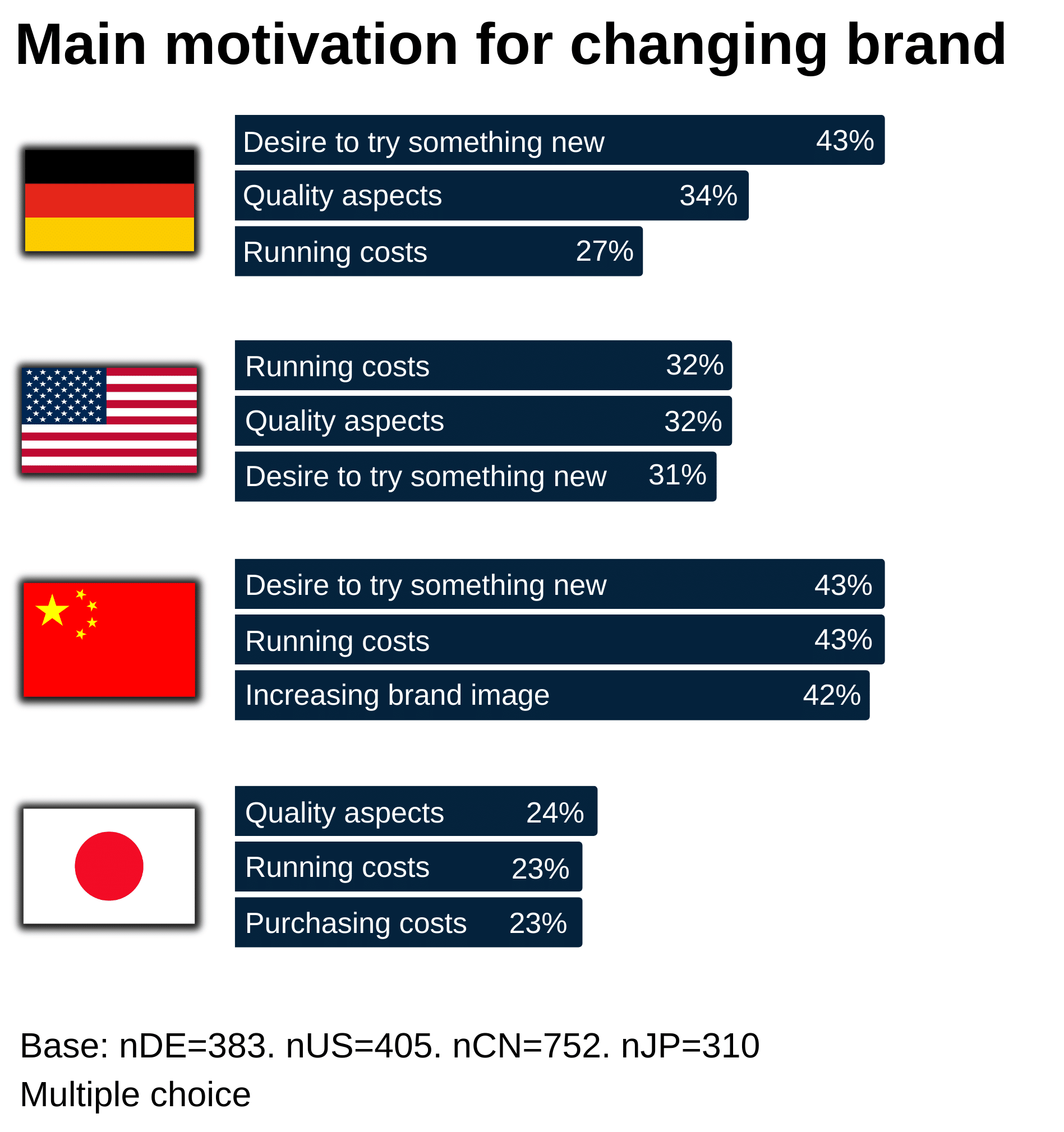

When questioned about the most bothersome aspects of their current vehicles, users across all four regions pointed out issues such as “poor fuel efficiency,” “limited storage space,” and “excessive noise while driving.” These concerns also featured prominently as primary motivators for transitioning to a new car brand, with quality-related factors being significant for a third of respondents in Germany and the US. Additionally, considerations related to operating costs emerged as major influencing factors across all markets. In China, the desire for novelty was identified as the primary driver for switching to a different vehicle brand, particularly premium brands.

This aligns with the rising influence of established premium car manufacturers in boosting brand image, contrasting with volume manufacturers who are currently witnessing a decline in market share in China. Since the inaugural survey in 2020, fuel efficiency and running costs have remained pivotal factors in the purchasing process. Notably, the impact of all features influencing purchasing decisions has remained consistent across each iteration of the survey.

Key to Attracting Potential EV Buyers: Enhancing Battery Performance

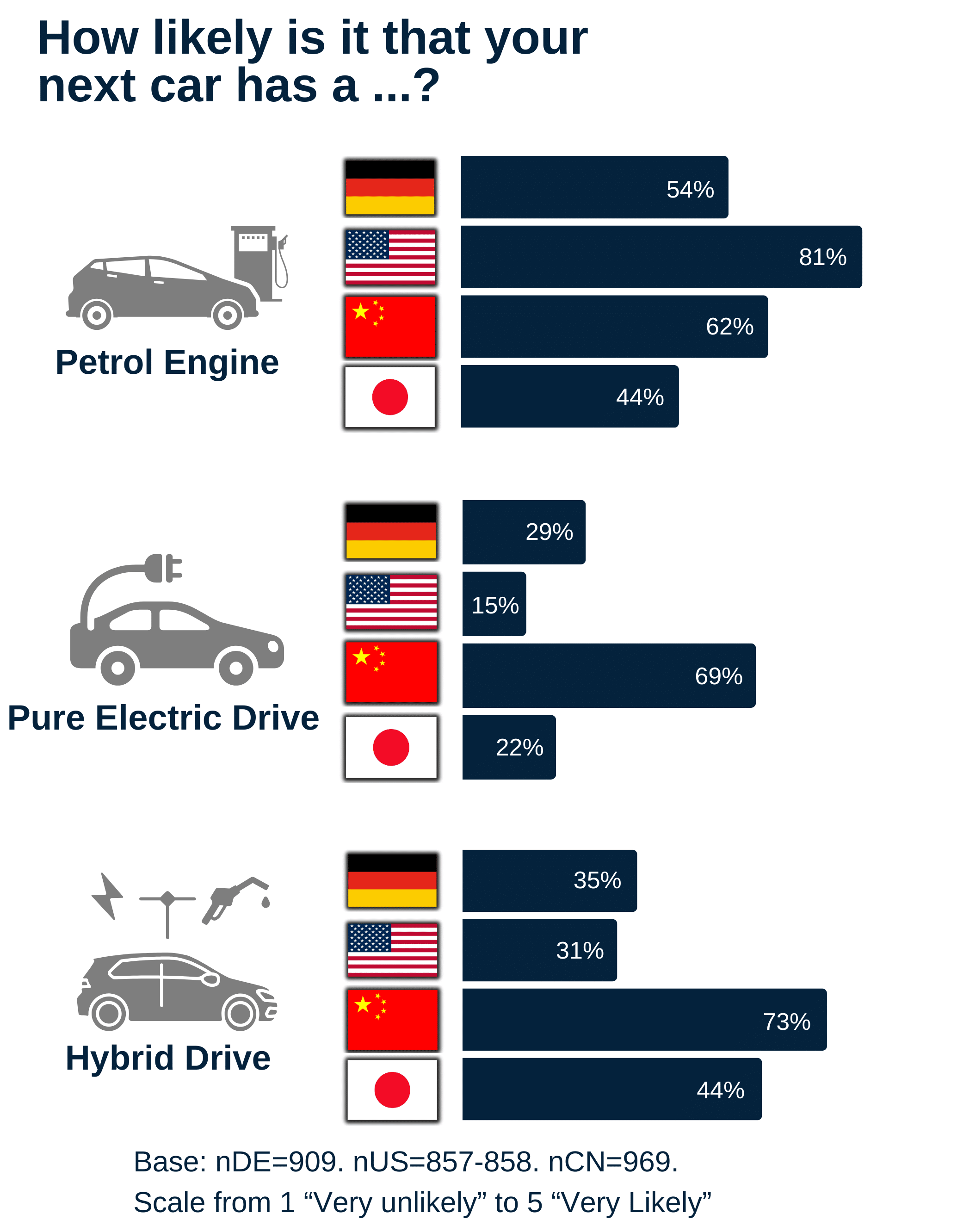

Driven by governmental incentives, technological advancements, and an expanding charging infrastructure, the market share of all-electric vehicles has been gradually increasing in recent years, particularly in Western markets and China. In China, 69% of respondents indicated a likelihood of opting for a pure electric vehicle for their next purchase. However, the willingness to transition to electric vehicles has shown no significant enhancement compared to 2020.

While there was a 6% and 8% rise in willingness to purchase electric vehicles in China and Germany respectively, there was a notable 14% drop in the US. Factors contributing to this sentiment at the close of 2023 include the reduction of governmental subsidies and the high price tag associated with electric vehicles.

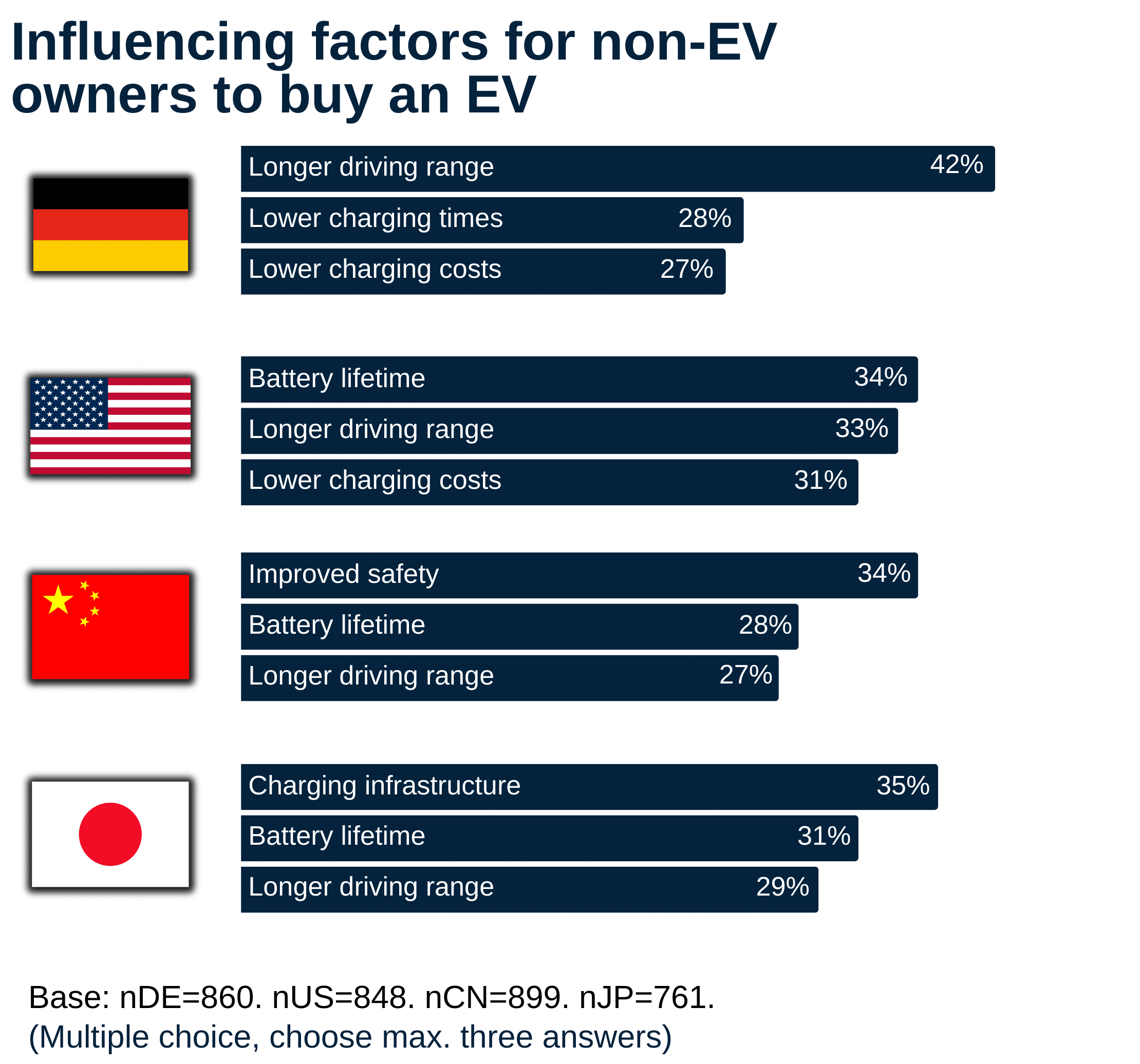

These findings emphasize the necessity for further technological advancements to win over a majority of car users. In addition to cost considerations, enhancements in battery performance, lifespan, and safety are imperative to augment the acceptance of electric vehicles across major regions. The primary drivers for transitioning to electric vehicles vary among regions, with driving range being the key consideration for German car users, while battery lifespan tops the priority list for 34% of respondents in the US. Conversely, 34% of non-EV owners in China prioritize improved safety when contemplating a shift to electric vehicles.

SOURCE: Asahi Kasei

[ad_2]