[ad_1]

During the annual shareholder meeting on Thursday, Tesla’s CEO Elon Musk described himself as a “facilitator for progress” for the company’s future. Shareholders approved a remuneration package for Musk amounting to $46 billion, based on the current stock prices.

Despite the anticipation for a pivotal change to reduce costs and facilitate developments like a $25,000 Tesla EV by 2023 and mass-production of the Semi by 2021, the significant cost reductions of Tesla’s 4680 cells have yet to materialize as of 2024.

“We foresee achieving cost parity in our internal cell production by the end of this year, which poses a significant challenge,” Musk stated.

The objective of Battery Day and the 4680 was to cut costs by half

Although Musk now speaks of cost parity, the reality surrounding Tesla’s groundbreaking battery initiative remains starkly different nearly four years post the September 2020 Battery Day. Tesla showcased the 4680 cells and its future self-production as the focal point of the event, claiming that the breakthrough cell would cost half as much, in terms of energy, compared to suppliers. Moreover, Tesla boasted about the possibility of supplying these cells to other automakers.

Comparison between 4680 vs. 2170 – Panasonic

“Presently, our 4680 cells are more expensive than those of our suppliers,” Musk disclosed on Thursday, highlighting the volatility in EV battery prices. “They are priced higher than our suppliers’ currently, but compared to a year ago, they are now more cost-effective.”

“The fluctuation in battery cell supply reflects a pattern similar to the industry for VRAM chips,” he remarked. “However, we are optimistic about achieving cost parity, possibly even undercutting current supplier prices by the end of this year.”

Tesla’s significant battery investment has yet to yield desirable results

The dynamics of EV battery supply costs have been tumultuous. Following Battery Day, EV battery prices surged in 2022, impacting EV affordability. However, by 2023 and extending into the present year, lithium-ion battery prices have been declining, showing no signs of stabilization. Analysts at Goldman Sachs project a nearly 40% reduction in EV battery prices between 2023 and 2025, which is expected to bolster sales.

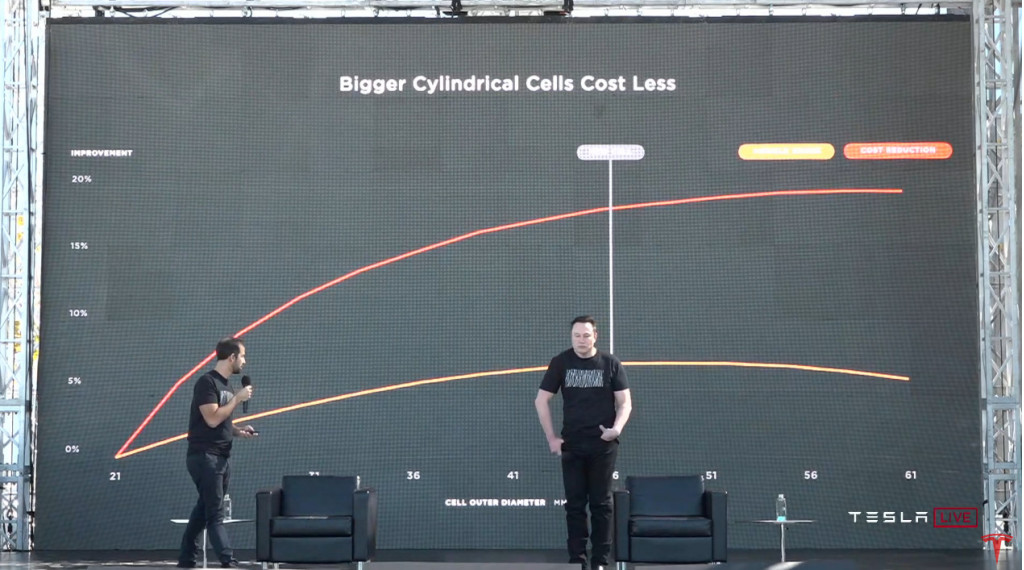

Tesla Battery Day – Bigger costs less

The landscape of EV battery supply economics has shifted significantly since Battery Day. There exists a surplus of battery production globally, mainly originating from China, which now manufactures adequate batteries to meet the global demand for EV production, as reported by Bloomberg New Energy Finance in the spring. Notably, no major automaker has committed to adopting the 4680 cylindrical format (46 mm diameter, 80 mm height) except for BMW, which opted for the 4695 format (same 46 mm diameter, but taller at 95 mm).

Musk stated in 2021 that without Tesla’s production of the 4680 cells, the company would not have sufficient supply for the mass-production of the Semi – a milestone in the Semi’s development that Musk recently confirmed during this week’s event.

In 2021, Panasonic’s chief battery executive mentioned that manufacturing the 4680 cell format would necessitate new methodologies; however, this did not deter other prominent battery suppliers from expressing interest in producing the new format.

2025 Tesla Cybertruck – Courtesy of Tesla, Inc.

Lars Moravy, Tesla’s VP of engineering, provided an update on 4680 production during the Q1 financial call in April, indication a production rate equivalent to around 7 gigawatt-hours per year. This capacity is deemed adequate to keep up with the Cybertruck production ramp, considering it is currently the only model utilizing these cells.

While Tesla may be nearing comparability with other battery technologies and manufacturers soon, achieving half the cost remains as distant a prospect now as it was in 2020.

[ad_2]