[ad_1]

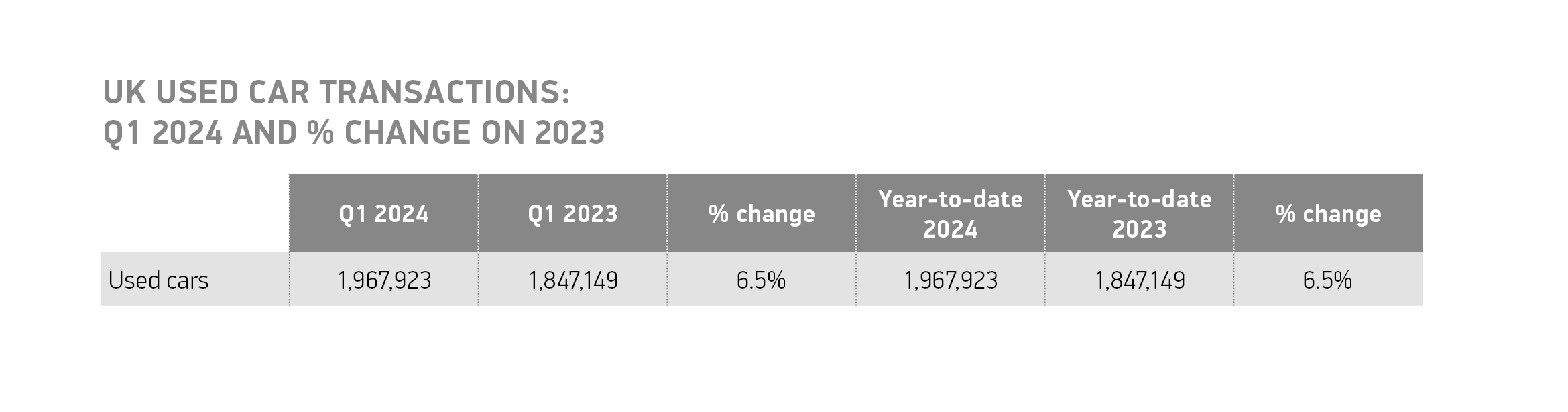

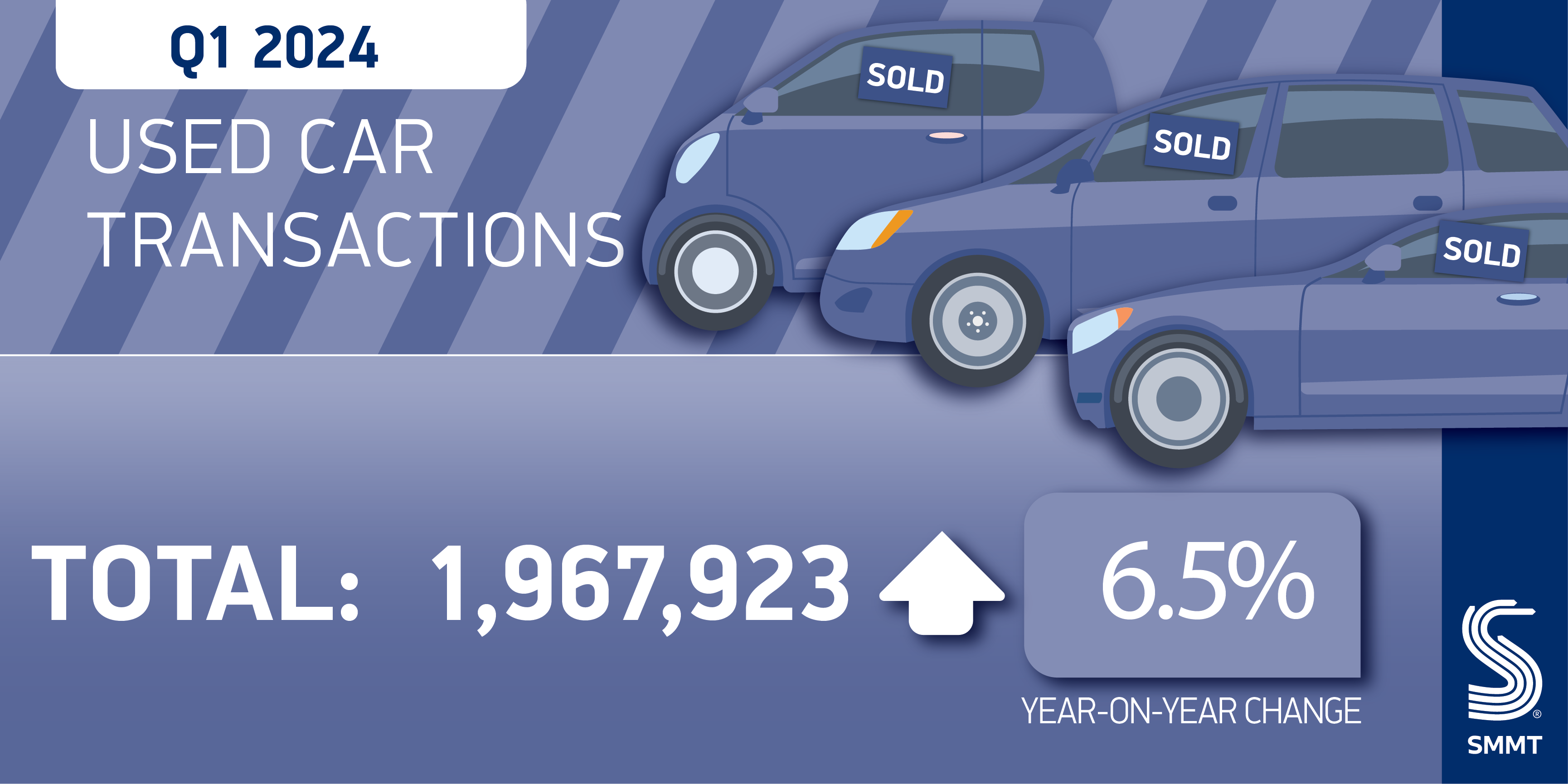

The British pre-owned car sector saw a 6.5% surge in the initial quarter of 2024, with 1,967,923 vehicles changing hands – the most robust beginning to a year since before the pandemic in 2019, as per the most recent data disclosed today by the Society of Motor Manufacturers and Traders (SMMT).1

This growth represents 16 consecutive months of expansion, mirroring the recovery in the new car market which is subsequently enhancing the supply and variety of used cars. While used car deals have climbed every month so far this year1, despite this steady growth, transactions for the quarter remain -2.6% compared to pre-Covid levels.2

The used sector is witnessing a rising number of electric battery vehicles (BEVs), with a substantial 71.0% increase in Q1 sales to 41,505 units – achieving a record high market share of 2.1%. This makes BEVs the most rapidly expanding powertrain as more purchasers are drawn to the potential cost savings and environmental advantages. Hybrid Electric Vehicles (HEVs) also continued to see increased sales, with 74,502 units changing hands, an uptick of 49.3%. Plug-in hybrids (PHEVs) experienced a boost in popularity as well, with a sales increase of 42.5% to 22,065.

During the quarter, traditional powertrains maintained their dominance, with petrol car sales advancing by 7.7% to 1,130,396, while diesel sales declined by -1.3% to 697,718 units. Collectively, these vehicles represented 92.9% of all transactions (1,828,114 units), with their market share shrinking by just over two percentage points from Q1 2023 as more buyers transition to electric vehicles.3

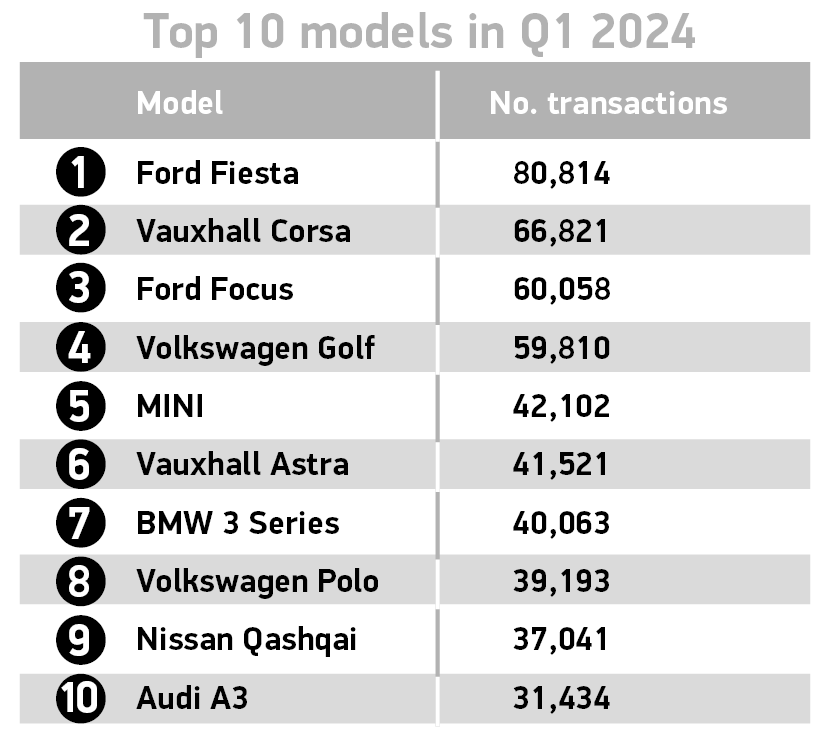

Superminis retained their status as the most sought-after vehicle category, with 640,711 transactions taking place – marking a 7.2% rise. Following closely, the lower medium segment experienced a 9.2% growth and witnessed the highest volume increase at 45,301 units. Completing the top three, the dual-purpose segment remained stable at 16.0% of the market and showcased the most significant percentage surge with a 10.3% increase. Combined, these segments accounted for three-quarters of all cars sold during the period.4 The executive, luxury saloon, and upper medium segments were the only categories to see declines, experiencing drops of -3.5%, -2.0%, and -0.5%, respectively.

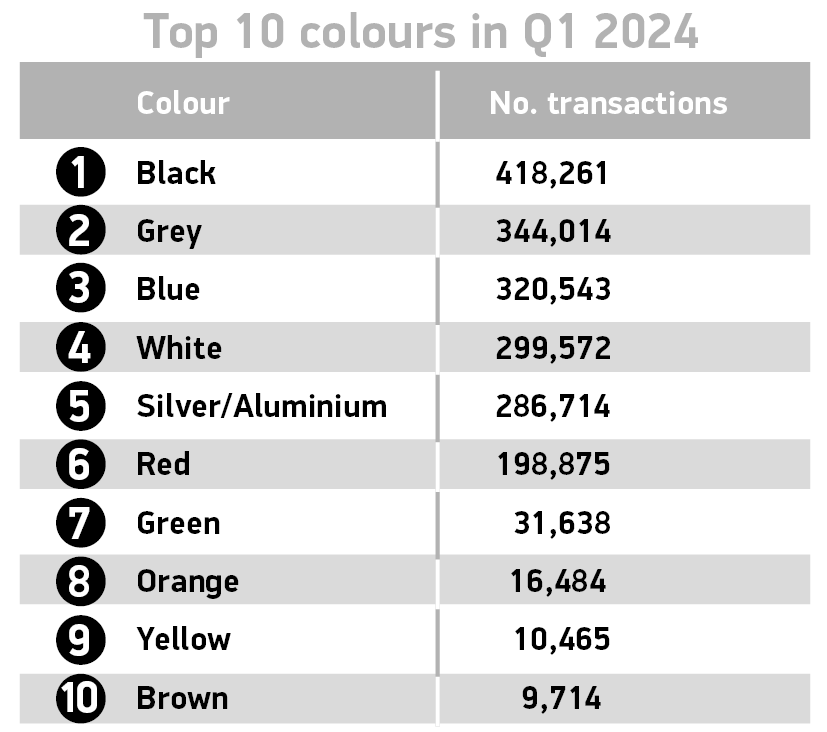

The top three color preferences remained unchanged from Q1 2023, with black leading the pack for the 13th consecutive quarter, representing 21.3% of sales. Grey, the most popular color for new cars, held onto the second spot but demonstrated the greatest growth in the top 10, climbing by 10.7%, while blue maintained third place, with a 6.2% uptick in deals. Gold and cream were the sole colors within the top 20 to encounter decreases, dropping by -2.5% and -0.6%, respectively.

Mike Hawes, SMMT Chief Executive, commented,

A reinvigorated new car marketplace is offering increased choices and affordability for used vehicle buyers, and increasingly, they are opting for electric options. To enable a larger segment of drivers to enjoy the advantages of emission-free driving, ensuring a robust balance between supply and demand is crucial. Encouraging the adoption of new Electric Vehicles and making investments in a well-distributed, accessible, and budget-friendly charging infrastructure will facilitate the nation’s transition to a carbon-neutral future.

All the data concerning used cars, as published by SMMT, is accurate based on the available information at the time of reporting. SMMT acquires used car data from DVLA, which periodically revises historical data, potentially leading to discrepancies in previously reported figures.

1. The growth rates in January, February, and March 2024 compared to the same period in 2023 are 5.1%, 7.7%, and 6.9%, respectively.

2. Used car transactions in Q1 2019 amounted to 2,020,144 units.

3. The combined sales of petrol and diesel vehicles in Q1 2023 totaled 1,756,405 units; Internal combustion engines held a market share of 95.1% in Q1 2023.

4. The combined market share of superminis, lower medium, and dual-purpose segments was 75.8%.

SOURCE: SMMT

[ad_2]